The Finance Bill which is targeted at amending six tax provisions in the country has been passed by the members of the upper legislative chamber of the National Assembly, according to Channels Television.

The Details: The bill was passed into law during today’s plenary session after it scaled the third reading on the floor of the Senate.

The separate legislation under the bill include Companies Income Tax, Value Added Tax, Customs and Excise Tariff, Capital Gains Tax Act, Petroleum Profit Tax, Personal Income Tax, and Stamp Duties Act.

The bill was passed after the report of the Senate Committee on Finance was presented by Senator Adeola Solomon.

Members of the Senate took turns to debate the aftermath of the bill on the people as a whole.

Senator Abdullahi Yahaya supported the passage of the bill while singling out revenue generation as a problem facing the country.

“The problem of our economy is the problem of revenue; the issue of economy is one that is beyond politics to me,” the Senator said.

Former Ogun State Governor, Senator Ibikunle Amosun drummed support for the bill as he chose to stand with Senator Yahaya on the matter.

“This is not about party but about our country. I will support this bill and will urge my colleagues that we should do away with partisanship,” he expressed.

However, there were opposing voices over the separate legislation under the Finance bill like the Value Added Tax (VAT). Senator Enyinnaya Abaribe, Minority leader of the Senate was against the increment of VAT from 5% to 7.5%.

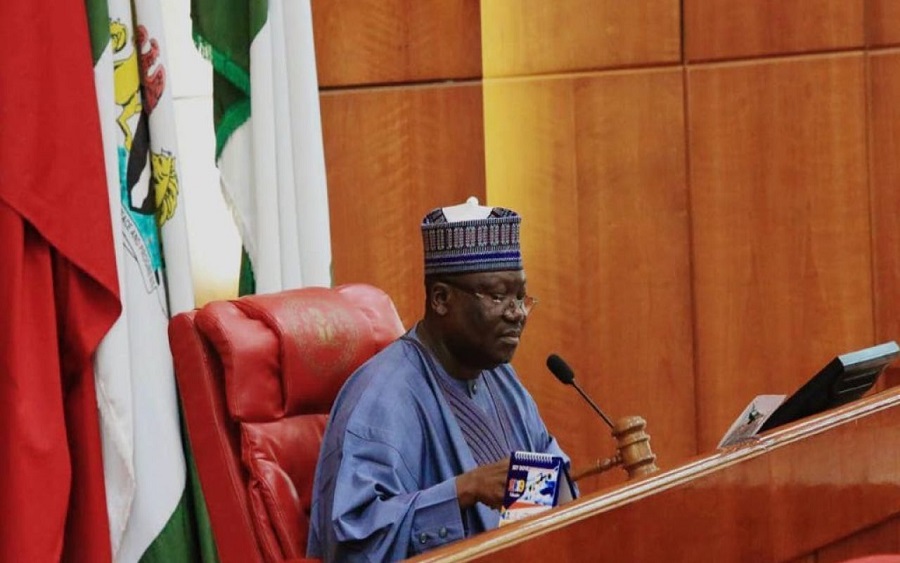

Senate President, Ahmed Lawan refused to take his prayer into consideration because Abaribe did not raise it on time. Lawan was the opinion that Lawan should have raised his concerns at the second reading of the bill.

Lawan added that the bill is not to bring untold hardship to Nigerians but to generate revenue for the Federal Government.

“With time, we should look at things to do in case some hard unintended consequences come up,” he added.

What you should know: The Finance Bill was presented to the joint session of the National Assembly on October 14 2019.

The President forwarded the Finance Bill 2019 for passage into law in pursuant to Sections 58 and 59 of the Constitution of the Federal Republic of Nigeria, 1999 (as amended).

The Finance Bill has four strategic objectives, in terms of achieving incremental but necessary changes to our fiscal laws. These objectives are:

• promoting fiscal equity by mitigating instances of regressive taxation;

• reforming domestic tax laws to align with global best practices;

• introducing tax incentives for investments in infrastructure and capital markets; and

• supporting Micro, Small and Medium-sized businesses in line with our Ease of Doing Business Reforms.

Source: nairametrics