What you need to know:

Uganda’s real estate prospects for 2025 appear highly promising due to several key factors driving the sector’s growth.

The country’s rapid urbanisation is creating increasing demand for both residential and commercial properties.

Additionally, ongoing infrastructure development, including improved transportation networks and utilities, will enhance accessibility.

The real estate market is finishing 2024 on a high note. Projects are beginning to take off, and there are a few key factors driving this positive momentum.

Real estate, as any business, operates in cycles. According to Moses Lutalo, the managing director of Broll Uganda Limited, this cyclical nature of the market means a continuation of growth and activity can be expected in 2025, especially as developers and investors navigate the challenges and opportunities that arise.

From the streets of Kampala to the emerging hubs of Wakiso and other suburbs, the landscape is shifting, offering both challenges and opportunities for developers, investors, and residents alike.

With policies such as the Land

Amendment Bill and a growing trend toward gated communities and mixed use developments, 2025 is set to redefine how Ugandans live, work, and invest.

Add to this the boost from industrial parks, enhanced road networks, and increased interest from foreign and diaspora investors, and the stage is set for a real estate revolution.

Recap of Uganda’s 2024 market performance

According to the Kampala property market performance review by Knight Frank, the prime residential market exhibited a slowdown in performance in the first half of 2024, marked by a low volume of sales and lettings and a minimal one percent decrease in occupancy levels compared to the first half of 2023.

In the period under review, the market was strained, with supply outstripping demand, thus creating a buyer’s market.

The increased residential properties supply was on account of stock from the development pipeline, off-loading properties through auctions and repossessions by banks and other credit institutions as well as individuals and companies disposing off properties to cater for their liquidity needs.

Lutalo also says the real estate market of Uganda in 2024 demonstrated significant resilience as the year as it moved to a close, fueled by steady economic recovery and urbanisation. Key factors such as infrastructure development, increasing interest in gated communities, and government initiatives like the Land Amendment Bill have driven the sector forward.

However, challenges such as high borrowing rates and unregulated development continue to shape the market’s trajectory.

With Uganda’s population growing rapidly, particularly in urban centres such as Kampala, and the new cities of Wakiso, Mbarara, Mbale, Jinja and Fort portal among others, 2024 laid the foundation for transformative trends expected to define 2025.

“The emergence of mixed-use developments, government decentralisation plans, and foreign investor interest are also setting the stage for a vibrant, albeit complex, real estate landscape,” Lutalo says.

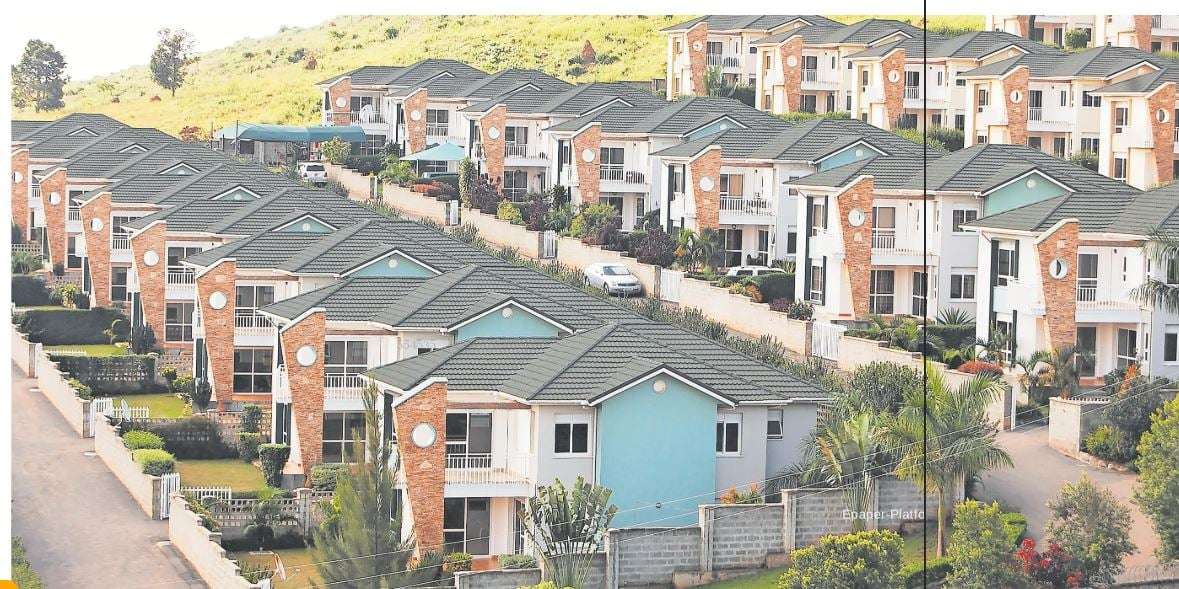

The residential properties supply is expected to grow in the new year. PHOTOS/TONY MUSHOBOROZI

According to property management firm, Knight Frank, old, detached houses and or re-development plots in the prime residential areas continued to be demolished and replaced with modern apartment blocks.

Developers were taking advantage of economies of scale from the densification of brownfield sites with multi-let units, increased rental incomes, and shared operational costs.

This trend was observed in the prime areas of Nakasero and Kololo, where new developers were debuting in high-density residential developments. This trend created a gap in the market for the supply of stand-alone houses, with tenants looking for standalone houses turning to the secondary residential areas of Mbuya, Munyonyo, Muyenga, and Bugolobi, among others.

Key trends driving the market

Urbanisation

Urbanisation remains a central force shaping Uganda’s real estate sector. Districts such as Wakiso and cities such as Mbarara are experiencing rapid population growth, driven by rural-to-urban migration. As Kampala struggles with congestion and inflated property prices, peripheral areas are becoming attractive alternatives for residential and commercial developments.

According to Miriam Tusubira, the proprietor of Infotrust Property Consultants, the opening of new cities has seen her clients easily embrace areas outside Kampala such as Mbarara and other suburban areas because of assumed developments.

“People no longer need to be in Kampala to enjoy urban living, which has in a way created more market for property across the country,”Tusubira says.

This shift has also spurred the demand for gated communities for home owners looking for security, quality planning and convenience.

According to Lutalo, projects such as the NSSF’s Lubowa housing estate and Royal Palms in Butabika highlight how developers are capitalising on this trend. These developments not only provide structured living environments but also cater to a growing middle class seeking modern amenities.

Government policies

The government’s push for regulatory oversight, such as the Land Amendment Bill and the proposed Real Estate Bill, is expected to stabilise the sector.Historically,Lutalo says real estate in Uganda has been under-regulated, creating opportunities for corruption and unsustainable price inflations, particularly in areas like Kira and Wakiso.

“By introducing clearer guidelines and mechanisms to monitor land transactions, the government aims to create a more transparent and equitable market,”Lutalo says.

However, such policies also come with short-term challenges. Developers may face delays due to compliance requirements, and landlords could struggle with the implications of proposed relocating government offices away from privately-owned buildings in Kampala to centralized hubs like Bwebajja.

Gated communities

The rise of mixed-use developments is a trend to watch in 2025. These projects combine residential, commercial, and recreational spaces, allowing residents to “live, work, and play” within the same area. Examples include the planned communities in Garuga and the expanding Lubowa estate.

Mixed-use developments, according to Lutalo, not only address housing shortages but also reduce dependency on city centers. For instance, someone working and living in Lubowa may rarely need to travel to Kampala, cutting transportation costs, reducing congestion, and minimising carbon emissions. This self-contained model is increasingly attractive as Uganda’s urban areas face mounting infrastructure pressure.

Predictions for 2025

Infrastructure development

Infrastructure development is expected to be a key driver for real estate in 2025. Projects such as the Kampala-Jinja Expressway and industrial parks in districts like Namanve are transforming previously overlooked areas into real estate hotspots. These projects enhance connectivity, making areas such as Wakiso, Mukono, and Mpigi more accessible and attractive for residential and commercial investment.

According to Tusubira, lack of roads affects the price of different properties.

“I have had ample land to sell but because the area lacks infrastructure, it would be hard to sell to people at the price it deserves. However, with more roads under construction, it is easier to sell property that was once hard to sell,” she says.

Infrastructure development not only develops areas, but also the lifestyle of people living in the area, which directly affects the market value of property. A notable development, according to Lutalo, is the government’s plan to decentralise operations by relocating agencies to areas such as Bwebajja. Inspired by models cities such as Dodoma in Tanzania and New Cairo in Egypt, this move aims to reduce congestion in Kampala and create new economic hubs.

While this will undoubtedly disrupt occupancy levels in Kampala’s Central Business District, Lutalo believes the long-term benefits include creating satellite cities, improving service delivery, and decongesting the capital.

However, he says this transition is likely to challenge landlords in Kampala, as government agencies vacate prime office spaces. The market will need to adapt by repurposing these properties, possibly into co-working spaces or startups-friendly serviced offices.

Old, detached houses in the prime residential areas were demolished and replaced with modern apartment blocks

Foreign and diaspora investments

Foreign investors and the Ugandan diaspora are expected to play an increasingly significant role in 2025 as has been seen in 2024. Favourable macroeconomic indicators, such as controlled inflation and projected GDP growth above six percent, are making Uganda an attractive destination for real estate investment, according to Lutalo.

Additionally, tax incentives for certain sectors such as luxury hotel construction, signal the government’s commitment to attracting foreign direct investment. Security and infrastructure stability remain critical in maintaining investor confidence.

“For the diaspora, the rising popularity of gated communities provides an opportunity to invest in secure, well-planned residential properties. These communities, often marketed as lifestyle upgrades, appeal to Ugandans abroad who wish to return home or secure rental income,” Lutalo says.

Prime residential units

Demand for prime residential units continues to be driven by the expatriate community working in Uganda and Ugandans in the diaspora, according to a review by Knight Frank. There has been a noticeable preference for two and three-bedroom apartment units and standalone houses respectively.

Naguru, Kololo, Nakasero, Mbuya, and Bugolobi dominate as the preferred prime residential areas; however, there has been increased interest in Lubowa, Kigo, and Muyenga areas.

The increased interest is from developers looking to set up gated communities to compete against the continued supply of apartments in Kololo.

Challenges and opportunities Despite the optimism, challenges persist. High borrowing rates continue to limit local developers’ access to credit.

The government’s reliance on domestic borrowing competes with private sector funding, pushing interest rates to as high as 22 percent.

A Knight Frank review, 2024, reveals that the tight monetary conditions (Central Bank Rate (CBR) increased to 10.25 percent, the highest since May 2017), high interest rates (averaging 20.8 percent), and high inflation levels affecting disposable incomes negatively, creating a credit squeeze.

The credit squeeze led to a slow market performance worsened by the buyer’s indecisiveness due to numerous options. The average prime monthly rents for two and three-bedroom apartment units in the review period remained stable compared to early, to mid-2023, while occupancy levels declined marginally from 82 percent to 81 percent.

“Addressing this requires exploring alternative financing mechanisms, such as issuing long-term Eurobonds, to ease pressure on commercial banks,” Lutalo says.

Meanwhile, unplanned urban sprawl remains a concern. To address this, stakeholders must enforce stricter urban planning regulations while incentivising developers to invest in organised projects such as gated communities.

Uganda’s real estate prospects for 2025 appear highly promising due to several key factors driving the sector’s growth.

The country’s rapid urbanisation is creating increasing demand for both residential and commercial properties. Additionally, ongoing infrastructure development, including improved transportation networks and utilities, will enhance accessibility and stimulate property investments.

Regulatory reforms aimed at streamlining the sector and ensuring transparency are also set to boost investor confidence.

With these drivers in place, Uganda’s real estate market is positioned for significant expansion, presenting ample opportunities for both local and international investors.