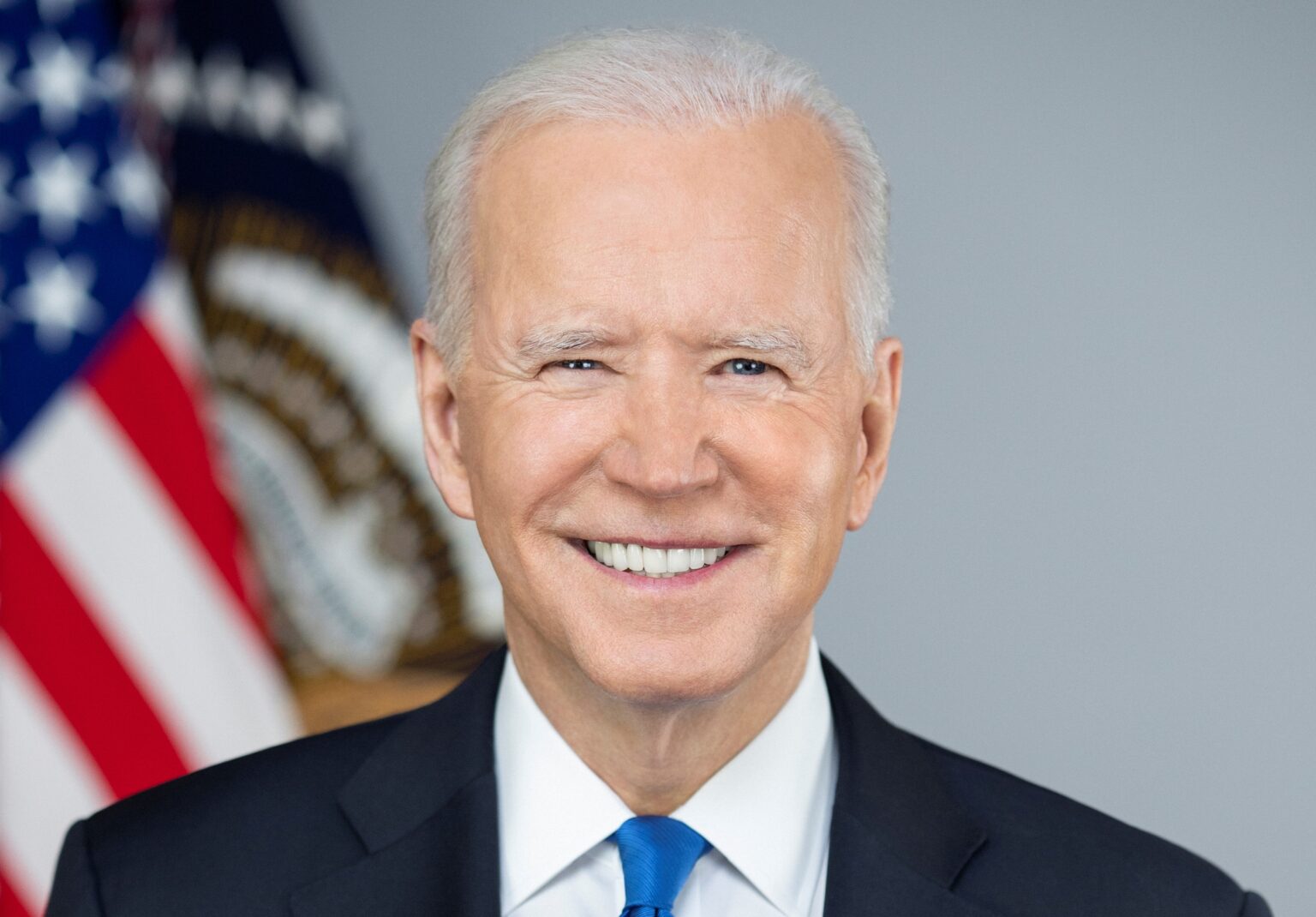

As President Biden said last week, tackling inflation is his top economic priority. Today, President Biden is releasing a Housing Supply Action Plan to ease the burden of housing costs over time, by boosting the supply of quality housing in every community. His plan includes legislative and administrative actions that will help close America’s housing supply shortfall in 5 years, starting with the creation and preservation of hundreds of thousands of affordable housing units in the next three years. When aligned with other policies to reduce housing costs and ensure affordability, such as rental assistance and downpayment assistance, closing the gap will mean more affordable rents and more attainable homeownership for Americans in every community. This is the most comprehensive all of government effort to close the housing supply shortfall in history.

The Plan will help renters who are struggling with high rental costs, with a particular focus on building and preserving rental housing for low- and moderate-income families. The Plan’s policies to boost supply are an important element of bringing homeownership within reach for Americans who, today, cannot find an affordable home because there are too few homes for sale in their communities. And it will help reduce price pressures in the economy, as housing costs make up about one-third of of the market basket for inflation, as measured by the Consumer Price Index.

Under the Plan, the Administration will:

- Reward jurisdictions that have reformed zoning and land-use policies with higher scores in certain federal grant processes, for the first time at scale.

- Deploy new financing mechanisms to build and preserve more housing where financing gaps currently exist: manufactured housing (including with chattel loans that the majority of manufactured housing purchasers rely on), accessory dwelling units (ADUs), 2-4 unit properties, and smaller multifamily buildings.

- Expand and improve existing forms of federal financing, including for affordable multifamily development and preservation. This includes making Construction to Permanent loans (where one loan finances the construction but is also a long-term mortgage) more widely available by exploring the feasibility of Fannie Mae purchase of these loans; promoting the use of state, local, and Tribal government COVID-19 recovery funds to expand affordable housing supply; and announcing reforms to the Low Income Housing Tax Credit (LIHTC), which provides credits to private investors developing affordable rental housing, and the HOME Investment Partnerships Program (HOME), which provides grants to states and localities that communities use to fund a wide range of housing activities.

- Ensure that more government-owned supply of homes and other housing goes to owners who will live in them – or non-profits who will rehab them – not large institutional investors.

- Work with the private sector to address supply chain challenges and improve building techniques to finish construction in 2022 on the most new homes in any year since 2006.

Today’s rising housing costs are years in the making. Fewer new homes were built in the decade following the Great Recession than in any decade since the 1960s – constraining housing supply and failing to keep pace with demand and household formation. This mismatch between housing supply and housing demand grew during the pandemic. While estimates vary, Moody’s Analytics estimates that the shortfall in the housing supply is more than 1.5 million homes nationwide. This shortfall burdens family budgets, drives up inflation, limits economic growth, maintains residential segregation, and exacerbates climate change. Rising housing costs have burdened families of all incomes, with a particular impact on low- and moderate-income families, and people and communities of color.

As his Action Plan reflects, President Biden believes the best thing we can do to ease the burden of housing costs is to boost the supply of quality housing. This means building more new homes and preserving existing federally-supported and market-rate affordable housing, ensuring that total new units do not merely replace converted or dilapidated units that get demolished.

The President continues to urge Congress to pass investments in housing production and preservation. One independent analysis of proposals in the House of Representatives-passed reconciliation bill found that the housing-related proposals would finance close to 1 million affordable homes. Key provisions, like the expansion of LIHTC and the Neighborhood Homes Tax Credit, have received bipartisan support. The President’s 2023 Budget includes investments in housing supply that would lead to the production or rehabilitation of another 500,000 homes.

Building on the actions the Administration announced last September to build and rehabilitate 100,000 homes over the next three years, these legislative proposals and the new administrative steps being launched – in partnership with state, local, for-profit, and non-profit partners – can put the economy on a path to closing the housing supply gap in the next five years.

Providing Incentives for Land Use and Zoning Reform and Reducing Regulatory Barriers

One of the most significant issues constraining housing supply and production is the lack of available and affordable land, which is in large part driven by state and local zoning and land use laws and regulations that limit housing density. Exclusionary land use and zoning policies constrain land use, artificially inflate prices, perpetuate historical patterns of segregation, keep workers in lower productivity regions, and limit economic growth. Reducing regulatory barriers to housing production has been a bipartisan cause in a number of states throughout the country. It’s time for the same to be true in Congress, as well as in more states and local jurisdictions throughout the country.

To that end, the Administration is taking the following immediate steps:

- Leveraging transportation funding from the Bipartisan Infrastructure Law (BIL). Earlier this year, the Administration began using federal transportation programs to encourage state and local governments to boost housing supply, where consistent with current statutory requirements. For example, this year, the U.S. Department of Transportation (DOT) released three funding applications for competitive grant programs totaling nearly $6 billion in funding that reward jurisdictions that have put in place land-use policies to promote density and rural main street revitalization with higher scores in the grant process. Today, the Administration is announcing that DOT will continue to include language encouraging locally driven land use reform, density, rural main street revitalization, and transit-oriented development in BIL and other transportation discretionary grant programs.

- Integrating affordable housing into DOT Programs. DOT will also issue updated program guidelines that increase financial support for Transportation Infrastructure Finance and Innovation Act (TIFIA) program projects that include residential development.

- Including land use within the U.S. Economic Development Administration’s (EDA) investment priorities.EDA evaluates all project applications for its competitive grants to determine the extent to which they align with EDA’s investment priorities. EDA already includes transit-oriented and infill development within its “Environmentally-Sustainable Development” priority. Over the coming year and before its next round of grants, EDA will add language to its investment priorities to encourage economic development projects that enhance density in the vicinity of the development.

These actions build on the strategies that the Administration has proposed and continues to call on Congress to pass:

- Unlocking Possibilities Program. The Unlocking Possibilities Program, proposed by President Biden and included in the reconciliation bill passed by the House last year, would establish a new, $1.75 billion competitive grant program, administered by HUD, to help states and localities eliminate needless barriers to affordable housing production, including permitting for manufactured housing communities.

- Housing Supply Fund grants to reduce affordable housing barriers. Building on the Unlocking Possibilities Program, the President’s 2023 Budget includes a mandatory spending proposal that would provide $10 billion in HUD Grants to Reduce Affordable Housing Barriers for states and localities that have already adopted Housing Forward policies and practices to address challenges to housing supply production constraints. While Unlocking Possibilities would help states and localities undertake reform, the Housing Supply Fund would reward those that have already made reforms by giving them additional funding to boost the affordability and maximize the benefits of their new policies. This funding would also support broader housing development activities, including environmental planning and mitigation, road infrastructure, and water or sewer infrastructure.

Piloting New Financing for Housing Production and Preservation

A second, significant barrier to increasing housing supply is a lack of attractive and low-cost financing for new construction and rehabilitation – particularly for units that are affordable. While the federal government currently offers a range of financing options for large multifamily development, market gaps exist for the construction and rehabilitation of single-family homes, 2-4-unit properties, ADU construction, manufactured and modular housing delivery, and smaller multifamily properties. Financing for these housing types has the potential to boost supply in constrained markets, and create location-efficient, modest density that can improve labor market outcomes and reduce greenhouse gas emissions – particularly when paired with state and local policies that remove barriers to where these kinds of housing can be located.

To that end, the Administration is taking the following immediate steps:

- Supporting production and availability of manufactured housing. The majority of people buying new manufactured homes rely on personal property financing (chattel lending) rather than conventional mortgages. This type of financing typically costs more than traditional mortgage financing due to higher interest rates and shorter loan terms. Freddie Mac has announced that it will complete a feasibility assessment for the requirements and processes necessary to support loan purchases of personal property manufactured housing loans. If FHFA approval is obtained, Freddie Mac will purchase these kinds of loans to assist with product design and support future loan purchase capabilities. Beyond personal property financing, both Fannie Mae and Freddie Mac (the Enterprises), in their Duty to Serve Plans, also released revised purchase targets for manufactured housing loans, which will have the effect of fostering greater liquidity for manufactured housing and increasing delivery of manufactured homes. Finally, recognizing the cost and development time savings provided by manufactured housing, HUD is making it easier to finance new units and helping manufacturers update their designs to meet changing consumer demands. This includes working to increase the usability of FHA’s Title I loan program for Manufactured Housing, supporting greater securitization of Title I loans through Ginnie Mae’s platform, updating the HUD Code to allow manufacturers to modernize and expand their production lines, and helping manufacturers respond to supply chain issues.

- Scaling Up ADUs and piloting ADU and home renovation financing tools. As the Biden-Harris Administration highlighted at a recent event, a number of states and local jurisdictions have made land-use changes to permit the construction and renovation of ADUs, which can offset the cost of homeownership while expanding the supply of affordable rental housing. According to a recent independent analysis, these kinds of state and local reforms – when combined with policies to improve financing options – could lead to the creation of more than 1 million ADUs in the next five years. In addition to zoning and land use changes, achieving that goal will require simpler and more affordable financing options for homeowners and builders. To that end, FHA and FHFA are exploring avenues to help lenders pilot and scale renovation and construction financing for ADUs—particularly for low- and moderate-income homeowners – in addition to new financing options for other single-family renovations and for 2-4-unit rehabilitation. FHA and FHFA will evaluate the credit performance of these loans to identify opportunities to add features and flexibilities to existing loan programs, expanding affordable financing options for homeowners and builders.

- Boosting rural single-family construction. USDA’s Construction to Permanent program, allows approved lenders and homebuilders participating in the Single Family Housing Guaranteed Loan program to close both construction and permanent financing at the same time and receive a loan note guarantee before construction begins. This additional certainty has the effect of encouraging more single-family supply to be built more quickly in rural areas throughout the country. In the months ahead, USDA will educate lenders on the benefits of the program in order to improve program utilization, increase new construction in rural areas, and address obstacles that may be limiting use of the program.

These actions build on the strategies that the Administration has proposed and continues to call on Congress to pass:

- Provide tax credits to build and rehabilitate 125,000 homes for low- and middle-income homebuyers. The Neighborhood Homes Investment Act, proposed by the President and included in last year’s reconciliation bill, would provide tax credits to encourage investment in the millions of homes that are otherwise too costly or difficult to develop or rehabilitate. It also requires that these homes are sold to owner-occupants, rather than large investors. This investment would boost the supply of affordable homes for low- and moderate-income homebuyers who have struggled with historically low availability of affordable, starter homes – and has received bipartisan support in Congress.

- Provide Housing Supply Fund financing for affordable housing production to develop 500,000 units of housing for low- and moderate-income renters and homebuyers. The President’s 2023 Budget includes a proposal for $25 billion for Grants for Affordable Housing Production. These resources would be distributed to State and local housing finance agencies and their partners, territories, and Tribes, and would be focused on streamlining financing tools to reduce transaction costs and increase housing supply through multifamily and single-family housing units of modest density (up to 100 units per site). HUD will encourage grantees to develop housing that directly meet identified local needs, especially housing that is not sufficiently provided by the market. This includes intergenerational housing, investments that place vacant or underutilized properties back into productive use, ADUs, and novel and non-traditional development techniques, including modular, panelized, or manufactured housing. States and localities would have flexibility to design their programs to meet local needs, and the resources would be used to support renters and homebuyers with up to 150 percent of area median income in high-cost areas. These investments, combined with complementary proposals in the Budget, would support the development of around 500,000 units of housing over the next 10 years.

Improving and Expanding Existing Federal Financing

Multiple forms of federal financing have played a critical role over the years in boosting affordable housing supply. But more production is needed to make up for more than a decade of underbuilding before the pandemic, and existing programs need to work more effectively and efficiently in order to boost housing production at a pace that will close the housing shortfall in 5 years.

READ ALSO:REDAN: Housing Costs Will Rise due to CBN policies.

To that end, the Administration is taking the following immediate steps:

- Strengthening Enterprise financing for multifamily development and rehabilitation. Fannie Mae and Freddie Mac are working to determine how to expand and better market their forward commitment programs. These programs allow developers to secure financing to pay off a construction loan upon completion of construction and when the housing project has been approved for occupancy. In addition, FHFA will work with Fannie Mae to consider the feasibility, in addition to the safety and soundness, of purchasing Construction to Permanent multifamily loans. These single closing loans finance the construction of multifamily housing, in addition to serving as a permanent mortgage, which allows for the developers to only need one loan, thus reducing interest rate risk, loan resizing risk, and transaction costs – encouraging production and supply. These loans would not finance land purchases. Expansion of forward commitments and increasing liquidity for Construction to Permanent financing will provide a stable and low-cost source of capital for new construction of affordable multifamily units. These actions build on actions earlier this year to meet the demand for rental housing and growth in the multifamily originations market. For example, FHFA raised the maximum amount of multifamily loans Fannie Mae and Freddie Mac can purchase by 11 percent to a total of $78 billion in 2022. These purchases allow for more liquidity in the multifamily market, which in turn allows more deals to be financed. Last September, Fannie Mae and Freddie Mac also increased their equity investment in LIHTC deals, resulting in investments in over 7,000 units. The Enterprises anticipate further growing their LIHTC equity investments in the year ahead. And to ensure a strong focus on affordable housing and traditionally underserved markets, FHFA is requiring that at least 50 percent of the Enterprises’ 2022 financing for multifamily housing be targeted to mission-driven affordable housing.

- Leveraging American Rescue Plan funds for investments in affordable housing. Treasury has urged state, local, and Tribal governments to dedicate more of their American Rescue Plan funds to build additional affordable housing at lower costs for families and individuals.A broad range of affordable housing production and preservation activities are eligible uses of the American Rescue Plan’s State and Local Fiscal Recovery Funds, including development of multi-family or single-family affordable housing, preservation of existing affordable housing, permanent supportive housing, support for home repairs, homeownership assistance, rental subsidies, and other activities. To date, nearly 570 jurisdictions have committed over $11.7 billion to housing-related activities, with $3.2 billion committed to production and preservation. For example, Los Angeles County, California will invest $10 million into creating permanent supportive and interim housing for individuals and families with complex health or behavioral health conditions who are experiencing homelessness by constructing new modular, prefabricated, or container housing on County-owned or City-owned or leased property, and by the strategic renovation of existing County facilities. Denver, Colorado has allocated $28 million to the Affordable Housing Fund, which will support 400 newly constructed rental units, 200 preserved rental units, 50 newly constructed homeowner units, and work to acquire existing unsubsidized affordable or hotel buildings. And Erie, Pennsylvania will use $6.5 million to preserve and expand the supply of quality affordable housing, creating 100 units of new affordable housing, helping homeowners and small businesses bring their properties up to code, and providing low-interest loans for new homeowners.

- Finalizing the LIHTC “Income Averaging” proposed rule. To qualify for LIHTC, developers must make commitments to create housing that is affordable to households that meet specific income thresholds. Income averaging allows a developer to meet the same affordability goals by taking the average of the income for some households who are in the property as opposed to requiring all to meet the same threshold. This “average-income test” for LIHTC qualification will enable the creation of more financially-stable, mixed-income developments and make LIHTC-supported housing more feasible in sparsely populated rural areas. It will also facilitate the production of additional affordable and available units for extremely low-income tenants. By the end of September, Treasury will finalize regulations to provide needed guidance to developers using LIHTC equity to build multifamily housing that is rented to tenants across a wider income spectrum.

- Advancing HOME as a key tool for the production and preservation of affordable rental and homeownership housing. HUD will update guidance to strengthen the HOME Investment Partnerships Program. Through the reauthorization of HOME, updated guidance, and robust technical assistance, HUD will advance and streamline this critical resource for the creation of affordable rental housing and promotion of homeownership. HOME provides grants to states and localities that communities use to fund a wide range of activities including building, buying, or rehabilitating affordable housing for rent or homeownership or providing direct rental assistance to low-income people

- Continuing to drive housing production through the Federal Financing Bank’s Risk Sharing Program. Last September, the Administration announced that Treasury and HUD had finalized an agreement to restart the Federal Financing Bank’s Risk Sharing program. The program provides loans at reduced interest rates to state and local housing finance agencies to create and preserve high-quality, affordable homes. Twenty-two state agencies have been approved to use FFB, and HUD has committed to guarantee more than $1.3 billion in loans representing more than 7,100 affordable units. HUD will work in the months ahead to accelerate this work by encouraging more state and local HFAs to participate and explore the development of a permanent financing mechanism for these loans through Ginnie Mae’s securitization platform.

- Improving the alignment of federal funds to reduce transaction costs and duplications, and accelerate development. Affordable housing development projects often require more than one federal source of funding. The most common pairing is LIHTC and HUD funds, such as FHA Multifamily, the Housing Trust Fund, or HOME. But each funding source comes with its own set of requirements and procedures. To reduce transaction costs and duplication, and to speed development, the Administration will make changes to harmonize federal requirements across programs as much as possible – including through programs like HUD’s LIHTC Pilot Program, which streamlines FHA processing of mortgage insurance applications for projects with LIHTC equity. To encourage alignment of affordable housing subsidies, the White House, HUD, Treasury, and USDA will convene state housing agencies to discuss best practices on the alignment of applications, reviews, and funding.

- Supporting the construction of more than 8,000 rural multi-family housing units. In March 2022, the U.S. Department of Agriculture (USDA) announced a new fee structure that would lower initial and annual guarantee fees for lenders under the Section 538 program. This new fee reduction will encourage lenders to utilize the program to develop multifamily housing. USDA anticipates these fee reductions will facilitate a 84.5 percent increase over the pre-fee reduction volume.

- Disposing of federal properties to create affordable housing for people experiencing homelessness. Title V of the McKinney Vento Act allows for the disposition of federal property for re-use as housing for the homeless. While only a small percentage of disposed properties are suitable for this use, Title V is an important mechanism to create housing, especially in places with high rates of homelessness. GSA, HUD, and HHS are planning to issue new Title V regulations this summer. The goals of the proposed regulations are to make the disposition process easier to navigate for affordable housing developers and enable the creation of new affordable housing developments to serve people experiencing homelessness. In addition to the proposed regulations, HUD and GSA will strengthen the process to identify suitable properties, market them to potential developers, and enhance technical assistance.

- Supporting new and existing affordable housing in Indian Country. HUD will award Indian Housing Block Grant (IHBG) funding to Tribes and Tribally Designated Housing Entities to finance the construction of new affordable housing in Indian Country, and also make historic levels of annual IHBG formula funding available to them.

These actions build on the proposals that the Administration has proposed and continues to call on Congress to pass:

- Financing more than 800,000 affordable rental units by expanding and strengthening the Low-Income Housing Tax Credit. LIHTC offers federal income tax credits to private investors in exchange for investments in affordable rental housing. The House-passed reconciliation bill would increase tax credit allocations, provide additional capacity for private activity bonds to finance affordable housing, target tax credits for housing that serves extremely low-income Americans, and make it easier to use tax credits in Indian Country. The President’s 2023 Budget also includes a provision that would provide additional subsidy through LIHTC to developments that add net new supply and that would otherwise not be financially feasible. Given the longstanding bipartisan support for LIHTC, the Administration looks forward to working with Congress to pass these critical enhancements, as soon as possible.

- Expanding access to federal subsidies for the construction or rehabilitation of rental homes affordable to low and extremely low income households. Additional federal resources are needed to create housing affordable for people with the lowest incomes such as people experiencing homelessness. The House-passed reconciliation bill would bolster funding for successful housing subsidy programs that can pair with LIHTC to produce and preserve housing that is affordable for very- and extremely-low-income renters. These programs include the Housing Trust Fund, the HOME Program, Housing Choice Vouchers and the Project Based Rental Assistance program. Together, these investments would produce, preserve, and retrofit hundreds of thousands of deeply affordable, rental housing homes in big cities and small towns across the country.

- Addressing longstanding public housing capital needs. Nearly two million people across the country live in public housing. The House-passed reconciliation bill includes a transformative investment to rehabilitate and preserve public housing, addressing residents’ critical health, safety, and energy efficiency concerns.

- Preserving more than 10,000 multifamily rental housing units in urban and rural America. The House-passed reconciliation bill provides funding to preserve over 10,000 HUD-assisted multifamily rental properties that are at risk of deterioration and do not have other sources of repair funds. It also invests specifically in rural preservation through USDA, as rural communities face unique housing needs that are not always fulfilled by other federal housing programs. The bill would support the construction, rehabilitation, and affordability of thousands of multifamily units, including units that provide affordable, sustainable housing to farmworkers and their families.

Preserving the Availability of Affordable Single-Family Homes for Owner-Occupants

Beyond financing challenges, in recent years, the share of single family home purchases by investors has grown – comprising more than 25% of all purchases nationally in some months of 2021, with an even higher share in certain markets, like Atlanta, San Jose, and Phoenix. Well over half of these purchases were made by investors with more than ten properties, and almost a quarter of these purchases were made by investors with over 100 properties. Large investor purchases of single-family homes drive up home prices for lower-cost starter homes, making it harder for aspiring first-time and first-generation home buyers, among others, to access wealth-building opportunities from homeownership.

To that end, and beyond the proposed investments discussed above, the Administration is taking the following immediate steps:

- Directing supply to owner-occupants and mission-driven entities instead of large investors. After the Administration announced it would take steps to direct a greater percentage of the supply of FHA- and Enterprise-defaulted asset dispositions to owner-occupants and mission-driven entities instead of large investors, 50% of mortgage notes secured by vacant HUD-held properties were sold to non-profit organizations in a recent sale, rather than investors. This compares to just 10% in a typical sale. FHA and the Enterprises, at the direction of FHFA, have extended the period during which available real-estate owned (REO properties) are only made available to owner-occupants and non-profit organizations to 30 days. Large investors are only permitted to submit bids after that period. In addition, earlier this month, FHA announced it is expanding its Claims Without Conveyance of Title Process (CWCOT) to include the establishment of an initial exclusive Post-Foreclosure Sales Period for owner-occupant buyers, HUD approved non-profit, and governmental entities. FHA, FHFA, and agencies across government will accelerate efforts to direct available supply to targeted buyers by continuing to target the sale of at least 50 percent of mortgage notes to owner-occupants and mission-driven entities. Additionally, FHFA previously announced that it will prohibit the Enterprises from purchasing institutional investor mortgages for single family homes.

- Encouraging use of CDBG for local acquisition and local sales to owner-occupants and mission-driven entities. HUD also will provide technical assistance and update guidance on the “Use of CDBG Program Funds in Support of Housing” to promote acquisition, homeownership assistance, conversion of existing structures into rental housing and “starter” homes, housing counseling, and rehabilitation and reconstruction.

Addressing Other Constraints to Supply: Materials Costs and Labor Supply

During the pandemic, the price of goods used in residential construction has increased, squeezing already-tight project budgets and delaying completions. And even before, there has been limited adoption of potentially cost-saving, off-site building techniques used widely in other countries. Additionally, labor supply challenges in construction have made it harder for affordable housing developers to recruit and retain workers. In the months ahead, the Administration is committed to working with the private sector to address near-term constraints to supply and production – with the goal of achieving the most completed housing units in a single year in 15 years.

To that end, the Administration is taking the following immediate steps:

- Partnering with the private sector to address supply chain disruptions for building materials. Secretary Fudge, Secretary Raimondo, and other Administration leaders will meet with representatives from the building industry to explore additional actions that the federal government and the private sector can take in partnership to help turn the record number of homes under construction into completed homes where Americans can live. The Administration already has taken a range of short-term and long-term actions that will have the effect of easing price pressures for building materials over time. The Bipartisan Infrastructure Law included funding for wildfire resilience, forest management, and reforestation that will promote the health and resilience of our forests and timber supply. In addition, the Department of Commerce recently announced that it had reduced duties on softwood lumber shipments from Canada, as part of an independent and quasi-judicial process.

- Promoting modular, panelized, and manufactured housing – and construction R&D. Innovations in homebuilding, including manufactured, modular, panelized, precut, and additive construction, hold promise for increasing housing productivity and thus housing supply. HUD will highlight these and other technologies that can benefit affordable housing construction during the Innovative Housing Showcase on the National Mall in June 2022. HUD is also working to assess hurdles to modular and panelized housing posed by inconsistent state and local inspection requirements and standards, which limit economies of scale and potential cost savings. The Department of Energy also recently awarded $32 million in funding to support 30 next-generation building retrofit projects that will dramatically improve affordable housing technologies. These technologies include prefabricated, super-insulated wall retrofit panel blocks and 3D-printed modular overclad panels.

These actions build on the strategy that the Administration has proposed and continues to call on Congress to pass:

- Recruiting more workers into good-paying construction jobs. The House-passed reconciliation bill included funding for increasing the number of Registered Apprenticeships for career technical education, as well as for pre-apprenticeship programs like JobCorps and YouthBuild, which would increase the pipeline of construction workers. The President’s Budget includes a 50% increase in funding for Youth Build, invests $303 million to expand Registered Apprenticeships and $100 million for a new Sectoral Employment through Career Training for Occupational Readiness program, which will support training programs focused on growing industries, like construction. Additionally, the $1.2 trillion for training in the Bipartisan Infrastructure Law is creating good paying union jobs, many of them in construction. In addition, the Administration continues to call on Congress to pass comprehensive immigration reform, while the Administration acts administratively to accelerate visa processing and other improvements to our immigration system.

- Sources:Whitehouse.