Nigerian publicly quoted paint manufacturers felt the backlash of adulteration of products by smaller industry players and high production cost on their mid-year earnings numbers, evidenced by weaker sales and dwindling margins.

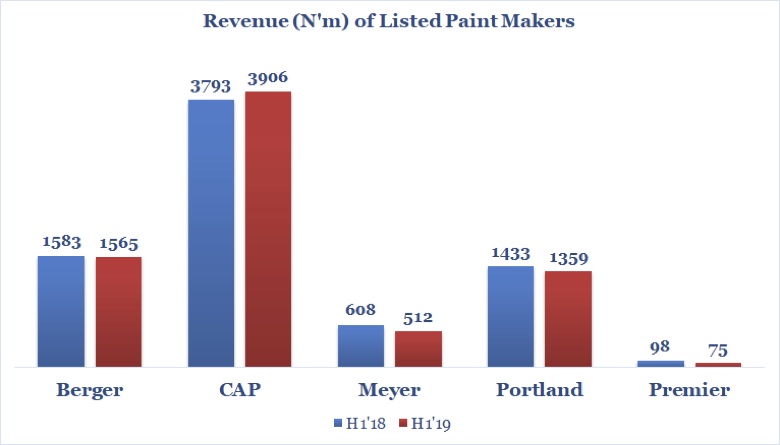

Between January and June 2019, Berger Paints, Chemical & Allied Paint (CAP), Premier Paints, Portland Paints and Meyer generated a combined sales revenue of N7.42 billion, which is some 1.3 percent or N94 million lower than N7.51 billion made a year earlier.

A report titled ‘The Nigerian Paints & Coating Market’ published by Frost & Sullivan, an American consulting firms with presence in six continents including Africa, cited high energy cost, government neglect, product debasement and high cost of raw materials as major woes that has been facing industry players over the years.

These challenges, they say, hurt margin of players and in some cases compel them to lower prices to the competitive nature of the market.

Of the five companies considered, only CAP, Nigeria’s biggest paint maker by market capitalization, saw positive revenue growth of 3 percent in the review period.

Sales of Berger Paints, Portland Paints and Meyer slumped by 1 percent 5 and 15 percent respectively, with Premier Paints bottoming with 24 percent contraction in top-line.

Generally, listed paint makers did not fare well in terms of profitability as two of five saw betterment in after-tax profit.

Berger Paints, the second biggest player by market value, led the pack with some 19 percent improvement in profit to N145.6 million, while CAP came a distant second with some 6 percent growth.

Post-tax profit of Portland Paints plunged 26 percent, while Premier Paints and Meyer saw losses reducing to N14.3 million and N29.6 million in the review period from N36.4 million and N93.9 million incurred last year.

To some analysts, cash flow generated from operating activities is the best metric to assess a firm’s ability to survive. This is because without positive cash flows, a firm may have to embark on borrowing, raise additional equity or quit operation.

A dive into the companies’ cash flow statement revealed that the five listed paint makers are cash-strapped as money earned from operations trended downward.

CAP generated N530 million from operations in H1 2019, to clinch the first spot, albeit this is 34 percent lower than N802 million realized last year.

Berger and Portland got N63 million and N14 million respectively from operations, representing a massive contraction from N106 million and N245 million earned a year earlier. While cash deficit of Meyer slowed to N40 million from N52 million, that of Premier Paint worsened to N3.3 million from N534, 000.

However, having negative cash flows for a time might not be a bad thing, if a firm is building another plant for example, could pay off in the end if the plant generates more cash.

Paint makers, for long, have been grappling with inability to source raw materials locally, as about 60 percent of inputs are imported and subjected to multiple levies, which further takes a toll on performance.

Despite this, three of five paint makers – CAP (52%), Berger (54%) and Portland (63%) were cost efficient in the first half of 2019 given their relatively low direct cost to revenue ratio.

Premier Paints saw cost margin trended slightly higher to 72 percent, with Meyer bottoming with 76 percent margin, a tangible upscale from 57 percent last year.

A cursory look at performance on the Nigeria Stock Exchange (NSE) revealed that leaders – CAP & Berger, have returned losses in excess of 20 percent year long.

The Nigerian paint industry can be broken down into two segments namely

Decorative Paints, Industrial paints and coatings.

The Decorative coatings comprises a majority of the Nigerian paints & coatings market representing an estimated 71percent of total volume and about 60percent of market value, while, the Industrial coatings accounted for about 29percent of total volumes in 2012 at an estimated $80 million.

Total sales volumes were an estimated 37 million litres. This segment can be broadly categorised into Industrial protective coatings, Marine coatings, Wood finishes, Coil coatings, Powder coatings, and Auto refinishes.

The Nigerian paint market is highly fragmented largely due to the low barrier of entry.

Major drivers of the industry are high demand for real estate properties, growing construction market, however, rising costs, growing competition coupled with activities of substandard and adulterated products has eroded the profit margins of most companies.

It is projected that sales value in the industry will reach an estimated $400 million in 2020, a Compound Annual Growth Rate of 9.01 percent.

If well protected, the paint industry looks very bright although this depends on economic recovery in the real estate sector which is still sluggish and big tickets projects. The Standard Organization of Nigeria must also ensure that only brands that meet standards are allowed in the Nigerian market.

Source: businessdayng