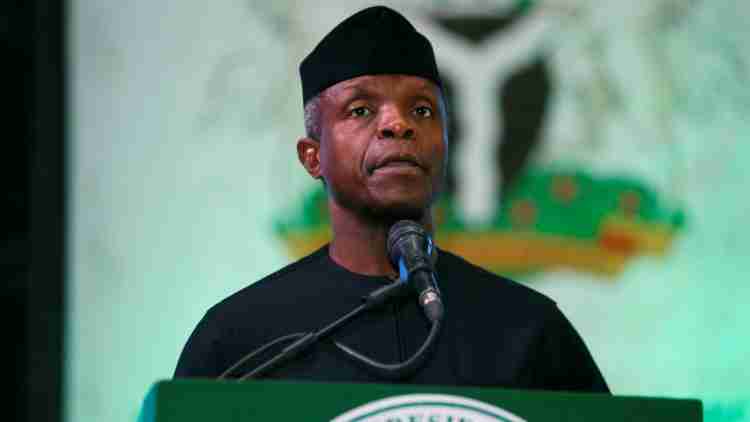

Vice President Yemi Osinbajo has charged Nigerian banks to invest more in transformative projects, especially housing and renewable energy, stating that the two sectors can significantly impact job creation and poverty reduction.

Osinbajo stated this yesterday in Abuja at the opening session of the 14th Annual Banking and Finance Conference themed “Economic recovery, inclusion, and transformation, the role of banking and finance.”

President Muhammadu Buhari had earlier declared the conference open and his Rwandan counterpart, Paul Kagame also delivered the keynote address.

In their separate remarks, Presidents Buhari and Kagame commended leaders in Nigeria’s banking and finance sector for their contributions to the development of Africa’s economy. President Buhari specifically urged the sector to support his administration’s efforts in job creation and poverty alleviation, listing some of government’s achievements in the areas.

According to the vice president in a statement by his spokesman, Laolu Akande , “It is time for the sector to take on some of the transformative big-ticket items that would fundamentally transform our economy. Such matters include consumer finance but housing finance in particular.”

He noted that a focus on how to finance housing is critical.

Referencing an African Development Bank (AfDB) survey, Prof Osinbajo said the housing sector supports poverty reduction and inclusive growth in two general ways, ‘’first, housing construction contributes to economic output, creates employment, and generates a demand for materials and related services. Second, improved housing raises the standard of living of occupants.’’

“That study (AfDB survey) says for example that the benefits of housing for individuals accrue in large part through better health and sanitation, and of course this improves the overall human capacity of our citizens who are able to own these houses. Housing also generates large multiplier effects in terms of employment and output. Employment is created for both skilled and poorer, unskilled workers.

“The evidence also suggests that there is a symbiotic relationship between housing finance and financial sector development.

Housing finance helps to develop the financial sector itself and helps to contribute to economic growth. So, these were the justifications that we also advanced for our mass housing initiative in the Economic Sustainability Plan,” he added.

Challenging the banking sector on participating in the federal government’s mass housing programme, the VP noted that “the finance sector appears shy or simply has not found the right housing finance model that will work.”

On renewable energy and mitigating the impact of climate change, Prof Osinbajo said, “One of the chief considerations especially for developing countries is how to pay for the massive transition to renewable energy. How do we pay for moving from where we are especially fossil fuel-based power sources to renewable energy? This is a significant challenge but it is also an enormous opportunity.”

Citing the federal government’s solar power initiative, Prof Osinbajo decried the low interest shown by commercial banks to catalyze installations or manufacturing for Solar Power Naija programme.

He explained that “the challenge of under-electrification of the rural and poor and its associated impacts on our economic well-being and security cannot be overstated. The climate change challenge is a massive one in more ways than we can imagine.

“I would like to encourage the Bankers Committee to refocus on supporting the Solar Power Naija to ensure that in the next few months we can catalyze access to the N140 billion and create 5 million connections that can multiply to eliminating our electricity access deficit and creating jobs.”

While commending the sector for its efforts in improving service delivery over the years, the VP noted that “going forward, the banking and finance sector must take advantage of the new opportunities that are opening up and also adapt to domestic and international developments.

“The rapid changes in the technology sector mean that financial technology companies and payment service companies are now an inescapable part of the banking and financial landscape.”

Prof Osinbajo also suggested that financial inclusion being critical to the objectives of recovery, inclusion and transformation, should be prioritized “especially in this COVID era, for the poor and more vulnerable sections of society so that they can keep their micro-businesses alive and handle risks and uncertainty,” he said.

Other dignitaries who spoke at the event include Governor Babajide Sanwo-Olu of Lagos State; governor of the Central Bank of Nigeria, Godwin Emefiele, and president of the Chartered Institute of Bankers (CIBN), Mr Bayo Olugbemi, among other bank executives across the country with several participants also joining virtually.