The under-listed are the several interventions, program and polices by several governments in the area of housing and urban development in Nigeria since independence on October 1 1960.

Until 1975, government in Nigeria did not explicitly accept any social responsibility for providing houses for the masses and therefore did not deem it necessary to participate actively in mass housing programmes apart from the housing schemes necessitated by occasional slum clearance activities. Between 1975 and 1980, 202,000 houses were planned to be provided for the public but only 28,500 units were realized, representing 14.1%.

The Federal Housing Authority was established through the promulgation of Decree No. 40 of 1973 and begins a formal operation in 1976. Part of its responsibilities is making proposals to the federal government on housing and ancillary infrastructural services and implementing those approved by government. In 1977 the Nigerian Building Society metamorphosed to Federal Mortgage Bank of Nigeria (FMBN) which serves as the main engine room for public housing delivery with a dual function of both primary and secondary mortgage institution.

In 1981/82, A National Housing Programme was designed to provide 350 medium and high income housing units in each of the then 19 states of the federation by the FHA. This is in addition to the national low income housing programme embark by the government in all the state of the federation popularly known as Shagari low cost.

A proposed 40,000 housing units were to be constructed all over the federation annually with 2000 units per state including Abuja, the federal capital city. The estimated target for housing delivery under this policy was 200,000 between 1981 and 1985 but only 47,500 were constructed across the nineteenth (19) states of the federation including Abuja, the Federal Capital Territory.

An ambitious housing policy was launched by the then military government in 1991 with a slogan “Housing for All by the Year 2000 AD.’ The National Housing Fund, NHF – a product of the 1992 Housing Policy of the Federal Government of Nigeria which is a legal instrument for mandating individuals and government to pool resources into mass housing delivery – was initially meant to facilitate the now discarded vision of housing for all by the year 2000 AD.

A Presidential Committee on Housing and Urban Development was set up on May 21, 2001 to review existing policies on housing and urban development, and formulate a new policy for the two sectors.

Presidential Technical Committee on Housing and Urban Development was set up in January 2002 to work out the organizational structure of the newly created Federal Ministry of Housing and Urban development; and to also restructure all the parastatals of Government with housing -related functions viz.: Federal Mortgage Bank of Nigeria (FMBN), Federal Housing Authority (FHA) and Urban Development Bank of Nigeria (UDBN).

Establishment of a Federal Ministry specifically for Housing and Urban Development in August 2003.

Restructuring and Repositioning of the Federal Mortgage Bank of Nigeria (FMBN) in 2003 for effective performance. FMBN now has a new organizational structure for secondary mortgage and capital market operations. The bank has been re-capitalised from N100 million to N5 billion under a new ownership structure comprising Federal Government 50%, CBN 30% and NSITF 26%.

Establishment of Real Estate Developers Association of Nigeria (REDAN) in May, 2002 for mass housing development.

Establishment of the Building Materials Producers Association of Nigeria (BUMPAN) in March, 2004 to enhance domestic production of building materials in a coordinated and regulated manner.

Legislative amendments to seven housing related laws which include the FMBN Act 1977, The Insurance Act 2002, The Investment and Securities Act 1999, The Mortgage Institutions Act 1989, The National Housing Fund Act 1992, The Nigeria Social Insurance Trust Fund Act 1993 and The Trustees Investment Act 1962.

Promotion of Public-Private Partnership (PPP) in housing delivery. Memorandum of Understanding (MOU) had been signed with over 50 Real Estate Developers in the last four years and some of the private developers have started building mass housing sequel to land allocation by Federal Ministry of Housing and Urban Development (FMHUD).

National Housing Fund management and operations have been reformed to make the fund easily accessible to prospective borrowers. Since 2006, interest loan on estate loan has been reduced from 15% to 10% and on loan to individual contributor from 9% to 6% per annum with a longer repayment period of 30 years as against 25 years previously.

National Technical Committee on Niger Delta was set up in July 2006 to develop a framework for the implementation of housing programmes in the Niger Delta Region.

The failure of these policies and programmes to adequately resolve the backlog of housing problems in the country led to the National Housing Policy (NHP) in 2006, but like others, the policy implementation proved deficient.

Under the current government of President Muhammadu Buhari, there are also a number of Affordable Housing Initiatives including The Federal Integrated Staff Housing (FISH) Programme (2016); My Own Home scheme (2017); The Federal Integrated Staff Housing (FISH) Programme (2016); National Housing Programme (2016); Family Homes Funds (2018).

In the mortgage sector, a lot of polies have been recently introduced, notably the mortgage interest drawback fund; the global standing instruction that will prevent non-performing loans from happening because there is now a hunting system that will go around to pluck incomes and funds from various accounts; and Uniform underwriting standard.

In spite of all these interventions, the housing situation in Nigeria has remained in a deplorable state. With the accompanying high rate of urbanization, it has emerged as one of the major problems facing Nigeria, most especially in the urban areas.

Yet, number of policies need to be introduced to stabilise the housing dynamics. There are still high interest rates which makes mortgages unattractive.

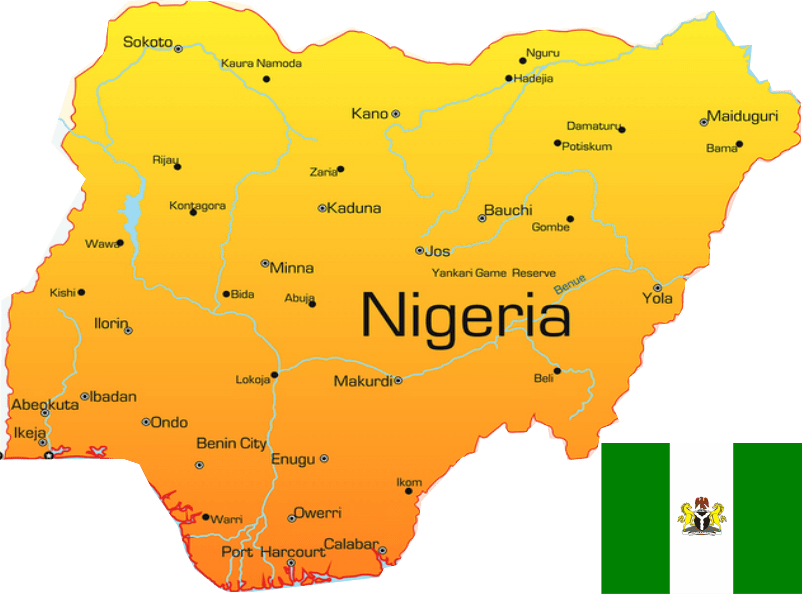

The next thing is the enabling environment, especially the legal enabling environment which is the land titling system and the foreclosure law. While states like Kaduna have passed that, with Lagos also at the forefront, more states needs to get on board immediately.

The recommendation from many experts in the sector borders on the need for political will to accompany the policies, as well as intense cross sector collaboration between and among stakeholders.

(Acknowledges- Prof. Nubi, University Of Lagos Inaugural Lecture)