Nigeria plans to amend dozens of its existing tax laws in a move that could see a major transformation of tax administration and compliance in the country.

Yet not much is known about the proposed changes in tax policies that would soon become law.

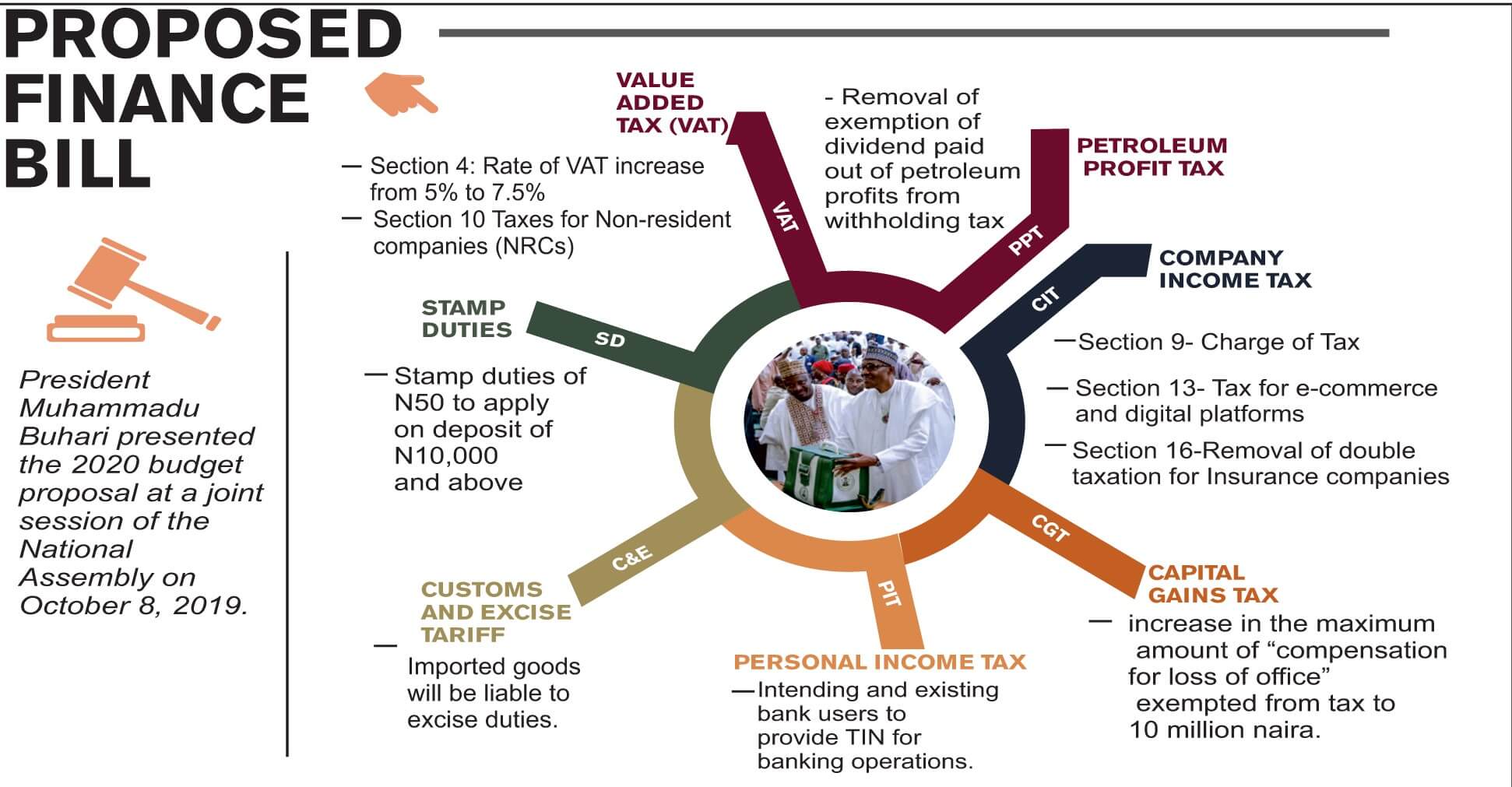

President Muhammadu Buhari presented the 2019 Finance Bill alongside Nigeria’s 2020 budget at a joint session of the National Assembly last month. The bill, which has so far scaled through the second reading at the parliament, aims to promote fiscal equity, reform local laws, introduce tax incentives, support small businesses, and raise revenues for the government, according to the president.

A copy of the Finance Bill seen by BusinessDay shows it contains changes to the Companies Income Tax (CIT) Act, Value Added Tax (VAT) Act, Petroleum Profits Tax Act (PPTA), Personal Income Tax Act, Capital Gains Tax Act (CGTA), Customs and Excise Tariff Etc. (Consolidation) Act, and Stamp Duties Act.

Companies Income Tax (CIT) Act

In the amended Act, Section 9 of the Companies Income Tax (CIT) focuses on charge of tax which was amended to ensure that companies are not taxed twice on the same income stream. The section introduces a specialised framework for securities lending transactions and stimulates activity in the nation’s capital market.

The Federal Government earned N358 billion in CIT in the third quarter of 2019, the highest this year and more than twice the average of N169.5 billion per quarter in the first half of the year, according to a recent report by the Central Bank of Nigeria (CBN).

Meanwhile, in a bid to synchronise taxpayers’ banking and tax databases to improve tax compliance and ease of tax administration, the bill requires all companies to provide their Tax Identification Number (TIN) as a precondition for opening a bank account or in the case of an account already opened before the 30th September 2019, such TIN shall be provided by all companies as a precondition for continued operations of their bank accounts.

This means henceforth request for Tax Identification Number becomes a prerequisite for opening bank accounts for individuals, while existing account holders must provide their TIN to continue operating their accounts.

Section 13 of the CIT focuses on e-commerce platforms and digital economy.

The amended Act expanded the basis for taxing non-resident companies with a significant presence in Nigeria by including digital, electronic services, online adverts & payments and services rendered outside Nigeria to a Nigerian beneficiary – if such trade or business comprises technical, management, consultancy or professional services outside Nigeria to a person resident in Nigeria.

This means foreign e-commerce platforms carrying out business transactions to Nigerians would also be taxed to ensure the country earns a fair amount of revenue from such activities.

To ensure that insurance companies are taxed in a fair and equitable manner relative to other companies operating in other sectors of the economy, section 16 of the CIT removes double tax provision and recognises regulatory cost that will be incurred by such companies in compliance with the conditions imposed by the insurance regulator. This includes, among others, provision for outstanding claims.

It also includes the restriction of deductible claims and outgoings to percentage of total premium, restriction of period to carry forward tax losses to four years, special punitive deemed profit basis for minimum tax computation, restriction of deductible unexpired risk and introduction of time-apportionment basis.

This means insurance companies can now carry forward tax losses indefinitely, deduct reserve for unexpired risks on time apportionment bases while special minimum tax for insurance has been abolished.

Also, to address the excess dividend tax rules which currently result in excess double taxation for corporates, Section 19 of the Act exempted tax on dividends paid out of retained earnings that have suffered tax under CITA, PPTA and CGTA.

This would help eliminate double taxation risks by exempting dividends paid out on retained earnings that have suffered tax under CITA, PPTA and CGTA, profits or income of a company regarded as franked investment, distributions made by a real estate investment company to its shareholders from rental income, and dividend income received on behalf of shareholders.

To further boost investment and remove cases of double taxation, Section 29 addresses loopholes that currently exist under the commencement and cessation period – the beginning and the ending of the reporting period.

The amended Act deletes the old basis for computing basis periods for new businesses and ceasing periods. It further introduces a simplified “actual year basis” for computing basis period during commencement and cessation periods.

According to the Act, where a company permanently ceases to carry on a trade or business in an accounting period, its assessable profit shall be the amount of the profits from the beginning of the accounting period to the date of cessation and the tax shall be payable within six months from the date of cessation.

Section 33 of the Act focuses on payment of minimum tax which would help promote fiscal equity.

Small businesses earning lower than N25 million turnover in any tax year will also benefit from the amendment as any business in that category will be exempted from Company Income Tax which is 30 percent of the profit earned by registered companies in Nigeria.

Similarly, medium-size companies will also have their bites of the government’s tax largesse aimed at helping businesses grow. Companies in this category with revenue running between N25 million and N100 million in any tax year will be required to pay a company income tax rate of 20 percent.

This means non-resident companies will now pay minimum tax.

To create incentives for early payment of tax under the self-assessment framework, Section 77 of the Act proposes a 2 percent and 1 percent bonus for a medium-sized and a large firm, respectively, where CIT liability is paid before 90 days to the due date of filing/payment.

The third schedule of the CIT Act addresses interest on foreign loans with restriction on tax exemption on foreign loans.

The seventh schedule introduces a thin capitalisation rule of 30 percent of EBITDA for interest deductibility. Any excess deductions can be carried forward for five years.

Value Added Tax (VAT) Act

A 50 percent upward review was proposed for the nation’s VAT rate to 7.5 percent from the current 5 percent, while the government introduced an exemption from VAT registration and filing obligations for companies with an annual turnover of N25 million or less.

The definition of goods was expanded to cover intangible products, property and assets but excluding land, among others. A definition for services was also introduced.

Furthermore, the VAT exemption list was expanded to include some other basic food items – defined as agro and aqua based staple food – such as additives, bread, cereals, cooking oils, culinary herbs, fish of all kinds (other than ornamented), flour and starch, fruits, live or raw meat and poultry, milk, nuts, pulses, roots, salt, vegetables, and water.

Other items introduced to the VAT list are locally manufactured sanitary towels, tuition (primary, secondary and tertiary education), and services rendered by microfinance banks.

The increase in VAT rate, which was to enable the government to generate additional revenues to fund its budget, would translate to increase in the prices of vatable goods.

While this could impact negatively on sales and cost of production of companies, the exemption of the companies with an annual turnover of N25 million or less would mitigate the effect of VAT policy review on the masses and motivate Small and Medium scale Enterprises to grow, thereby contributing to the aggregate economic activities of the nation.

Similarly, the introduction of threshold would also align local VAT laws with international best practice and protect the most vulnerable to the exposure to VAT.

Furthermore, the controversy over the definition of “basic food items” which has led to some court cases with the FIRS would be settled. The inclusion of fresh items to the exemption list would mean low-income Nigerians can purchase more items without paying VAT.

Petroleum Profit Tax (PPT)

Section 60 of the Act makes provision for the deletion of exemption for dividend paid out of petroleum profits. This means dividend from petroleum would be subjected to withholding tax.

Personal Income Tax

Personal relief and relief for children and dependent relatives will be deleted from the Personal Income Tax. Currently, individuals in Nigeria enjoy personal tax relief of N2,500 for each child up to a maximum of four children (at most 16 years), and a sum of N2,000 for each dependent relative up to a maximum of two who are widowed or infirmed or incapacitated by old age.

But with the planned amendment, the N2,500 and N2,000 tax reliefs for each child and dependent adult would cease to exist.

Also, the government seeks to ensure every bank user has tax identification number to further enhance tax collection. The bill requires both intending and existing bank users to provide Tax Identification Number for banking transactions, creating a room for tax authorities to track tax evaders and improve tax receipts.

Capital Gains Tax (CGT) Act

Section 50 of the CGT Act gives clarity on the circumstances under which CGT will apply to transfer of assets during business reorganisation. Also, Section 52 of the Act stipulates compensation for loss of employment below N10m to be exempted from CGT.

Customs and Excise Tariff

On customs and excise tariff, an amendment is sought for the fifth Schedule to the Customs and Excise Tariff Etc. (Consolidation) Act to include “goods imported” into Nigeria in order to incentivise local production. As a result of this, imported goods will be liable to excise duties, thereby getting rid of undue advantage the items have over locally made products.

This could discourage importation of some goods into the country, a move that could reduce the pressure in the country’s foreign exchange market.

Stamp Duties

The government clarified on the mode of stamping instruments. It noted that an impressed pattern, marked by means of an engraved, inked block dye as an adhesive stamp, an electronic stamp, or an electronic acknowledgment for denoting the duty would be regarded as a stamp. This is expected to formalise the way banks charge stamp duty and bolster government revenue.

Furthermore, the government introduced electronic payment option for stamp duty and also increased the stamp duty threshold to N10,000. This implies a one-off levy of N50 will apply to bank transfers on an amount from N10,000 and above.

A bank customer will not be charged stamp duty for transferring funds between his or her accounts in the same bank, while exemption shall be granted for share transfers and payments made in a Regulated Securities Lending transaction.

Source: Businessdayng