Housing is one of the most important needs of man that comes next to food and clothing in that order.

However, housing needs for low income earners in particular in Nigeria, has remained a mirage despite all the noise-making about affordable housing by the government at all levels.

The growing level of industrial and commercial activities in the urban centres has contributed to continuous drift in shortage of residential accommodation, as the existing supply of housing could not match the increasing level of demand, just as the rate of homelessness and high cost of rent is alarming.

Government’s drive toward housing for all as contained in the National Housing Policy, which aims to provide affordable housing for all, has not been achieved so far, and no serious efforts are being made toward implementation as it continues to be an illusion and frustration to the larger population.

Nigeria’s efforts towards housing for all as contained in the National Housing Policy of 2002, which objective is to provide affordable housing, have so far remained mere rhetorics.

This is because low-income earners mostly do not have enough for food, clothing, transportation and other family needs, and to meet these needs, it is impossible to save and buy or build a house because of financial restraints.

Most of the low income earners hardly have bank accounts, hence are not even eligible for bank loans or mortgages. In most cases, they are not qualified for employer’s loans because their income is too low to meet the repayment obligations.

This failure has been partly attributed to the lack of political will and poor implementation of the policy, and it is unfortunate that from time to time, the federal government makes continuous discrete policies and programme to address housing problems in Nigeria, but there seems to be no review mechanism that reports on the performance of these policies.

The right to adequate housing that is safe, secure, healthy, available and inexpensive is enshrined in the Habitat Agenda on the global call on human settlement and shelter (UN-Habitat 2001).

According to Pison Housing Company (2010), “There are about 10.7 million houses in Nigeria. Irrespective of the policies, organisations and regulations which the Nigerian government has put in place since independence in 1960, there is still housing shortage, especially for the low-income group.

“The Federal Mortgage Bank of Nigeria FMBN, which is answerable to the provision of mortgages to low-income earners through the National Housing Trust Fund NHTF, has operational and financial capability restraints that limit its efficiency. With this, the few low-income earners who can afford houses of their own, usually obtain land and build incrementally with their funds, while the high-income earners buy houses with money, or mortgage finance which they usually pay back over a maximum period of 10 years”

A major short coming has been with ownership rights under the Land Use Act of 1978, which confers ownership of all land to the Governors of each state and is a substantial deterrent to housing and housing investment in Nigeria.

In actual fact, this right of occupancy is endorsed with a Certificate of Occupancy issued to the recipient which often delays and adds significant costs to the documentation process.

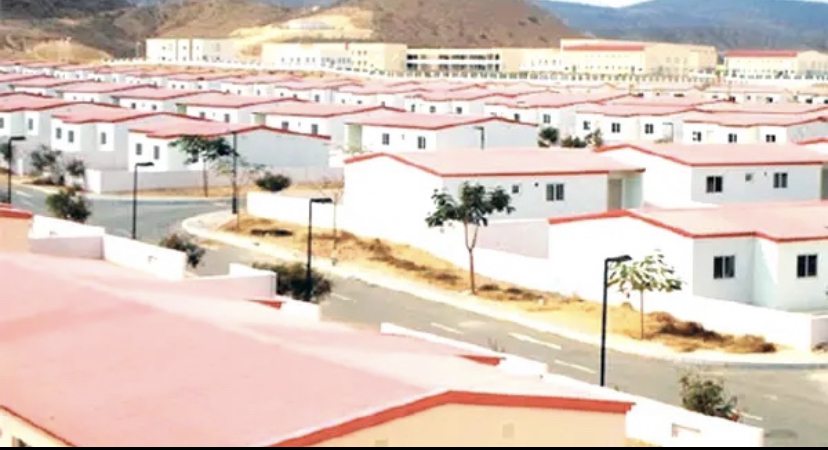

However, in spite of these constraints, some private developers who are determined to contribute their quotas to meet the huge housing need of the country have continued to churn housing units in their thousands at their various sites across the nation.

Within this era of Coronavirus pandemic, new homes have emerged in Abuja, Port-Harcourt, Lagos and other cities across Nigeria.

As its own contribution to the country’s housing need, a major player in the Nigeria’s housing industry, Lekki Gardens, has built over 8,000 units between 2012 and today help reduce the housing deficit in Nigeria.

According to reports, Lekki Gardens as a real estate development company, is pioneering luxury and affordable housing across Lagos, Abuja and Port Harcourt.

The Lekki-based company is believed to be meeting the housing needs of people across different segments of the property market with its various classes of housing types which include terraces duplexes, fully and semi-detached, maisonettes and flats of different categories of sizes such as one-bedroom apartment to five-bedroom apartment.

Besides its major priority which is housing delivery, Lekki Gardens is equally creating employment opportunities for local personnel of global repute at their project sites, and this intervention has led to the employment of over 10,000 people, directly and indirectly, according to the company sources.

However, the company’s major concern is about uptake, considering the low-income capacity of most prospective home buyers, as mortgage interest rates are too high, arguing that this situation needed government’s urgent intervention.

According to professionals in the sector, “These housing loans are ways for people to become homeowners. Yet, it has not taken off in Nigeria.

“Left to the private sector, Nigerian mortgages are not a viable option, as interest rates are in the double digits. If you are paying 15 per cent interest on a 35-year mortgage, you would have paid around five times the original value of the property.”

On low cost housing, the officials said, “In reality, current low cost housing projects are delivered at prices that are somewhat out of reach of people earning basic salaries.

“One way to get around this is for the government to promote low-cost technologies for mass housing units’ solutions through Public Private Partnership (PPP) arrangements.”