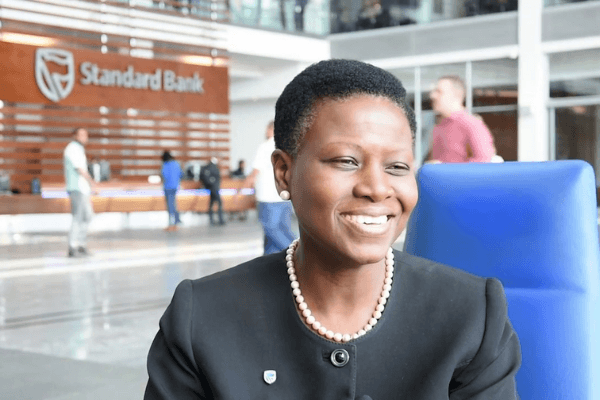

An outstanding female banker, Sola David-Borha, has grown organically in her career, breaking every barrier to become the chief executive officer (CEO), Africa Regions, the Standard Bank Group.

Until January 2017, Borha was the chief executive officer, Stanbic IBTC Holdings Plc – a financial services group with subsidiaries in commercial banking, investment banking, pension and non-pension, asset management and stockbroking.

Born in Accra, Ghana, to a diplomat father, Borha began her career at NAL Merchant Bank (now Sterling Bank), then affiliated with American Express from 1984 to 1989, before joining a boutique investment banking firm, IBTC, which was merged with two commercial banks to become IBTC Chartered in 2005.

Sola undertook her primary and secondary education in Nigeria before completing her studies at University of Ibadan with a Bachelor’s degree in Economics in 1981. She then proceeded to pursue an MBA from the Manchester Business School in 1991. Her executive education includes the Advanced Management Program at Harvard Business School and the Global CEO Program jointly offered by Wharton, IESE and CEIBS.

In 2007, Standard Bank Group acquired IBTC and became known as Stanbic IBTC Holdings. Borha served as deputy chief executive of the bank (Stanbic IBTC Bank) and head of international banking coverage in Africa (excluding South Africa), becoming chief executive of Stanbic IBTC Bank in 2011 and chief executive of Stanbic IBTC Holdings in 2012.

Her quest for success through hard work is evident in the books of the financial institutions she has chaired so far.

Stanbic IBTC Holdings recorded its most profitable year since inception of the bank in 2017 and 2018. Key extracts of the audited report and accounts of Stanbic IBTC Holdings for the year ended December 31, 2017 showed that gross earnings rose by 36 percent while profit after tax jumped by 70 percent.

Gross earnings rose to N212.4 billion in 2017 as against N156.4 billion in 2016. Profit before tax increased from N37.2 billion to N61.2 billion while profit after tax rose to N48.4 billion from N28.5 billion in 2016.

Total assets increased to N1.386.4 trillion in 2017, a 32 percent growth on N1.053 trillion recorded in 2016. The growth in the balance sheet size was driven mainly by customer deposits, which recorded a growth of 34 percent to N753.6 billion in 2017, from N561.0 billion in 2016.

For the year ended December 31 2018, the financial institution reported net interest income of N78.209 billion as against N83.587 billion in 2017, representing a decline of 6.43 percent. Profit before tax (PBT) of N88.152 billion recorded by the bank in 2018, from N61.166 billion in 2017, represents 44.12 percent increase. The company’s profit for the year 2018 stood at N74.440 billion, as against N48.381 billion in 2017, representing a growth of 53.86 percent. In 2018 financial year. Its basic earnings per share (EPS) stood high at N7.04, from N4.60 in 2017, up by 53.04 percent.

Following the group’s gross earnings increase by 4.67 percent and profit before tax increase by 44.12 percent for the year ended December 31, 2018, the board recommended approval of a final dividend of 150 kobo per share as against 100 kobo per share in 2017.

Standard Bank Group, largest African banking group by assets, with a market cap of approximately R289 billion ($20 billion) as at 31 December 2018, offering a range of banking and related financial services across the continent, dug deep into its Nigerian business in 2018 with the acquisition of additional shares worth N61.3 billion in Stanbic IBTC Holdings Plc to increase its majority equity stake in the Nigerian subsidiary to 64.44 percent. This was a year after Borha became the regional CEO of Standard Bank Group.

Checks by BusinessDay showed that the Standard Bank Group also reported profit for the year ended 31 December 2018. The group delivered sustainable earnings growth and improved returns.

Its performance was underpinned by the strength and breadth of client franchise. Group headline earnings grew 6 percent to R27.9 billion and ROE improved to 18.0percent from 17.1percent for the year ended 31 December 2017. The group’s capital position remained robust, with a common equity tier 1 (CET1) ratio of 13.5 percent. Accordingly, a final dividend of 540 cents per share has been declared, resulting in a total dividend of 970 cents per share, an increase of 7 percent on the prior year.

Banking activities headline earnings grew 7 percent to R25.8 billion and ROE improved to 18.8percent from 18.0percent in 2017. Non-interest revenue (NIR) continued to record strong growth, driven by retail banking. Net interest income (NII) growth was dampened, and credit impairment charges were lower as a result of the adoption of a new accounting standard.

The 2018 group results were less impacted by currency movements than in prior years. On a constant currency basis, group headline earnings grew 8 percent. Africa Regions’ contribution to banking headline earnings grew to 31 percent, from 28percent in 2017. The top five contributors to Africa Regions’ headline earnings were Angola, Ghana, Mozambique, Nigeria and Uganda.

Borha’s brilliance has earned her several academic recognitions and awards. She currently serves as the vice chairman of the board of the Nigerian Economic Summit Group, a position she has held since 2015. She joined the board of IBTC in July 1994. She has been a non-executive director of Coca-Cola HBC AG since June 26, 2015.

Borha served as a director at Stanbic IBTC Holdings PLC from 1994 to March 25, 2017. She is a member of the governing council of the Redeemer’s University. She is an Honorary Fellow of the Chartered Institute of Bankers of Nigeria (CIBN).

In 2016, Borha was singled out as the All Africa Business Woman of the Year at the All Africa Business Leaders Awards in Partnership with CNBC Africa.

Former Chairman of Stanbic IBTC Holdings Plc, Atedo Peterside, described her as one of the finest bankers of her generation, a consummate professional and an exceptional human being.

Borha is evidence that hard work and consistency pay regardless of gender, background or religion.

Source: businessday