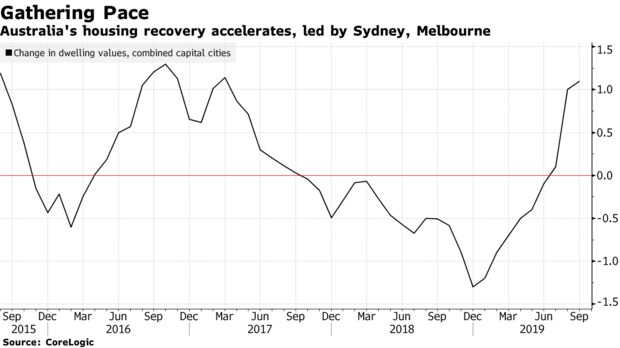

Australian housing prices rose in September, as the rebound in the nation’s property market gathers pace.

- Housing values in capital cities jumped 1.1% last month, CoreLogic Inc. data released Tuesday showed. Nationwide, prices gained 0.9%, the biggest jump since March 2017.

Key Insights

- The upswing is largely concentrated in Sydney and Melbourne, with home prices surging 1.7% in each last month. Strong population and jobs growth are powering the nation’s two largest cities, while remote towns like Hobart and Darwin continue to decline.

- FOMO (millennial speak for fear of missing out) is back. Auction clearance rates have jumped back to the mid-to-high 70% range as buyers try to snap up properties before prices rise further. That’s being fueled by a shortage of available homes, with the number of houses for sale still 10% less than a year ago.

- The Reserve Bank has copped some flak for reigniting the housing market with back-to-back rate cuts in June and July. The surge in house prices probably won’t be enough to stop it from paring rates to a record low 0.75% later Tuesday, with RBA Governor Philip Lowe last week saying he wasn’t particularly concerned about the housing borrowing binge.

- While policymakers and regulators “appear to be comfortable” with the housing rebound, CoreLogic’s head of research Tim Lawless warned dangers still lurk. “Household debt levels reached new record highs relative to incomes over the June quarter, suggesting the sector is vulnerable to a shock or change in household circumstances.” SOURCE:bloomberg.com