Pakistan’s population explosion and rapid urbanisation has left a growing number of people without access to decent, stable, affordable housing. The last census, in 2017, documents a housing stock of 32.2 million, of which 39% is urban. The urban population is expected to grow by 2.3 million people per year over the next 20 years. This translates into the demand for 360,000 households, at 6.3 individuals per households.

Poor access to affordable housing is also reflected in unequal home ownership: ownership remains concentrated in the top income bracket, leaving a limited supply of housing for low-income households. Housing insecurity among the bottom income strata of Pakistan has therefore become a compelling public policy issue.

A framework for affordable housing

There is little clarity on what constitutes affordable housing for the average Pakistani household. Globally, housing is defined as affordable if a basic housing unit, which provides a minimum amount of personal space (anywhere from 250 to 500 square feet) and amenities, is accessible at 20% to 40% of gross monthly household income for either rent or mortgage.

A basic working tool for computing actual and affordable housing prices is presented below to provide a basic framework for realistic and informed deliberations on housing economics and planning policies and strategies. The listed factors impacting housing costs, and therefore the ‘affordable’ and ‘actual’ housing price, is not exhaustive and can be expanded or contextualised for greater accuracy.

Occupancy:

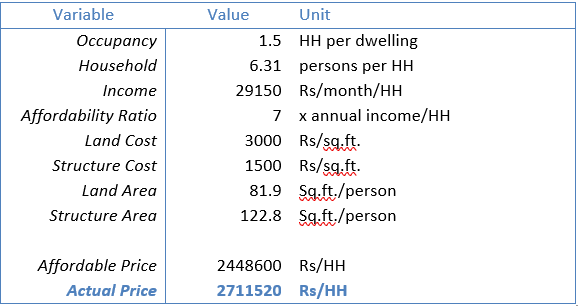

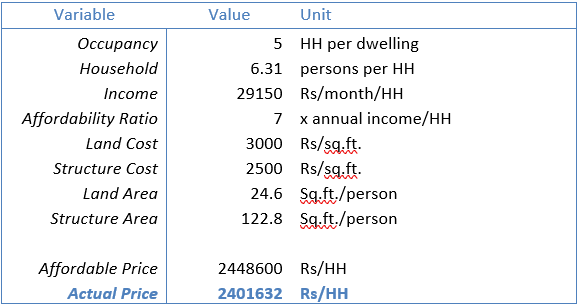

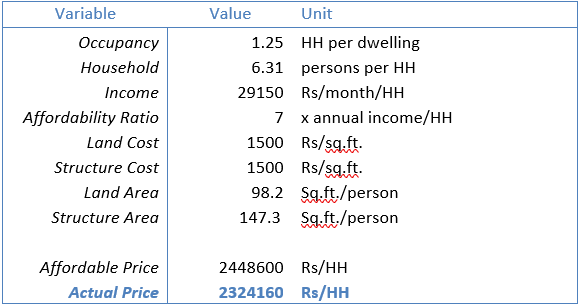

This refers to the number of persons living in a residential building and can be measured in terms of Households per Dwelling Unit (HH/DW). For the simulations presented here, we have taken average occupancy as 1.5 HH/DW for single family houses and 5 HH/DW in case of multi-storied apartments.

Household income:

According to the Household Integrated Economic Survey (HIES) 2015-16, the average Pakistani household of 6.3 persons, has a monthly income of PKR 29,150. This is almost half the internationally accepted poverty level of USD 2 per capita per day, which is equivalent to PKR 57,790 per average Pakistani household per month. This is even lower than the subsistence level of USD 1.4 per capita per day, or PKR 39,753 per household per month.

Affordability ratio:

The official National Reference Manual on Planning and Infrastructure Standards (NRM) presents models to determine affordability in terms of investment in years of household income, by taking into account the household propensity to save, duration, and interest rates of loans (NRM, page 45).

A household can afford a total outlay on housing not exceeding 2.7 times its annual income, as derived from financial analysis by the House Building Finance Company’s (a Pakistani state-owned housing finance company) loan conditions, which are more favourable than bank loans. If past personal savings and zero/low interest loans from relatives are included, the rule of thumb for affordability may be stretched to a capital investment equal to 3.5 times the annual household income.

The simulations here stretch this ratio still further to 7 times the annual household income, assuming the most favourable terms for loan interest and the repayment period.

Land area:

The NRM states the size for a plot of category ‘F’- the lowest income group – as 72 square meters (775 square feet). Assuming one household per plot, this would work out to be 122.8 square feet per person. However, the pressure on housing may lead to the average occupancy exceeding 1.5 HH/DW (NRM, page 46). The land area requirements per person can be reduced by increasing occupancy, for example, by increasing the number of stories for multi-occupancy dwellings.

Constructed area:

The NRM gives a maximum floor area ratio (FAR) – the ratio of a building’s total floor area to the size of the piece of land upon which it is built – of 150% for category ‘E’ and ‘F’ plots. This comes to 1162.5 square feet per plot, or 184 square feet per capita for a single household occupancy.

This compares favourably with the average available floor area of 102 square feet per person in Asian cities (where the average is 9.5 square meters or 102.26 square feet): Hong Kong: 15 square meters or 161 square feet per capita. In Africa, the average is 8 square meters or 86 square feet per capita (United Nations Habitat, 2001).

Thus, there is room for increasing the density/occupancy. For multi-storied apartments, Building Regulations for Punjab recommend a FAR of 1:5 (Government of Punjab, 2007).

Land price:

Land price is highly variable within and across urban and rural locations in Pakistan, determined largely by the distance of the dwelling unit from the place of work and services such as health, education, and commercial activity. Thus, the availability of social infrastructure and transportation impacts both the effective cost of living and the market price of land.

In ‘greenfield’ developments, land prices are lower, but infrastructure development costs would need to be added to the actual price of housing. ‘Infill’ development, in both urban and rural locations, takes advantage of existing infrastructure, reducing ‘development’ costs but resulting in higher prevailing land prices.

Built area price:

Building costs are also highly variable, mainly due to the materials and technology used in the ‘grey’ structure, apart from the differences in the quality of finishes. In rural locations, where land prices are lower, larger land areas are affordable, allowing for low-cost, single-storied, and low-tech structures. In prime urban locations, where land prices are high, land area per household ends up being reduced, necessitating multi-storied construction with accompanying higher costs.

Table 1: Greenfield development is not an affordable option for the average Pakistani household

Table 2: High density infill development is the only affordable housing option in existing cities

Table 3: Infill development in existing rural settlements is the most affordable option

(These tables are based on simulations by Mr. Kamil Khan Mumtaz.)

Policy implications: affordability, subsidies and local development

Greenfield developments are not an affordable housing option for the average Pakistani household. Infill developments with high density multi-storied apartments in existing cities may be the only affordable housing option for urban populations. Infill development in existing rural settlements remains the most affordable housing option, with the added advantage of increased land area per person, facilitating production-based livelihood opportunities in organic farming, artisanal manufacture, forestry and animal husbandry.

Secondly, the role of subsidies as a solution in providing low-cost housing needs to be qualified: Somebody has to pay the actual price. Cross-subsidies can of course work, up to a point, if one product is over-priced to make up the balance for another product that is under-priced. The beneficiary enjoys the favourable market place while the subsidiser bears the extra cost.

The problem is when the subsidy is provided in the form of ‘common’ goods, such as public land, utility infrastructure, access to social infrastructure, tax waivers and financing terms. Here, the cost is borne by the public resources allocated to the subsidy, which could otherwise be allocated elsewhere. This is not feasible in a country like Pakistan, which is already in debt and experiencing broad based deficits in public service delivery: Subsidies are not affordable.

Thirdly, while densification of existing low-density urban areas has to be a part of the solution, terms such as ‘high rise’, and ‘vertical’ development need to be qualified. ‘High rise’ normally entails more than twenty stories. It implies very high costs of construction using high-tech materials, advanced construction technologies, and systems such as lifts and air-conditioning. This approach to development places a high load on utility infrastructure on high valued land.

This pursuit of development also requires participation and investment by large, mostly foreign, corporate entities: financiers, property developers, and construction companies. They are motivated by large profits, however, these profits exit the local economy. In contrast, low-rise, low-tech, high-density development (two or three, maximum five stories) implies lower costs and walk-up structures that can be built by local builders. In this case, money spent remains in the local economy, supporting development beyond access to affordable housing.