How Nigerian immigrants can buy a home in America in 36 months

Many Nigerians are emigrating abroad; many are leaving to start a new career and life in Canada, the United States and Europe.

This new emigree are highly educated and previously held a job in Nigeria; they will form the building block of the middle class in the future in their new nation.

Why is buying a home important

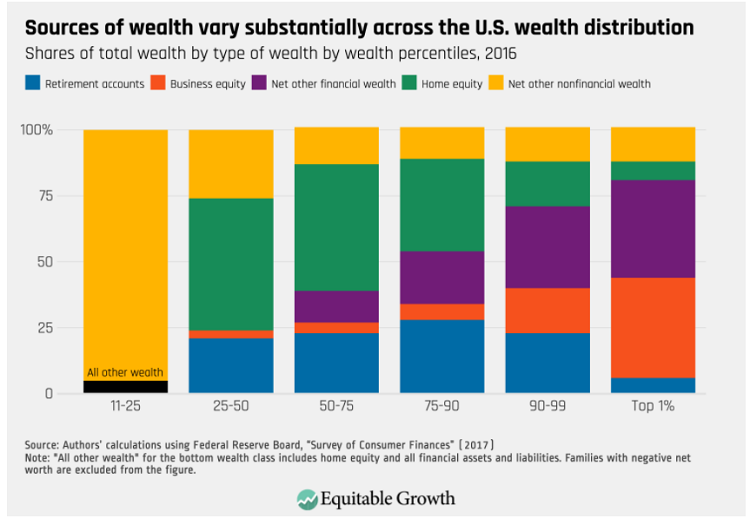

In a paper by the Washington Center for Equitable Growth titled “The distribution of wealth in the United States and implications for a net worth tax”, the authors analyze the sources of wealth in the US and who holds that wealth. From Diagram 1, we can see that home equity is the source of wealth of the 25% to 99% percentile in America. The article has this interesting quote “Low-wealth and high-wealth families differ in terms of the assets and liabilities. Cars and other vehicles account for most of the wealth for low-wealth families, and Middle-wealth families hold much more of their wealth in home equity.” In summary, homeownership is the pathway to wealth in the United States. Buying a home and deriving equity (the difference between your house is worth and what you owe) is a proven pathway to wealth in America.

Diagram 1: Sources of Wealth across the US

How can I become a homeowner in the US?

First, it is essential to understand the West has clear pathways to owning a home. The mortgage sectors are also well developed, and identification and credit scoring are taken seriously. The West is also a credit economy, meaning most transactions are conducted on a credit basis, not on a cash basis. Below, I will outline steps you should take if you are an immigrant and want to emigrate and buy a home. My example will be based on the US model. This process, in broad terms, will also work in Canada and Europe.

Ensure you have a paper trail showing how funds have left your Nigeria to the US. To purchase a home, you must show the ability to repay a mortgage loan. The first step is to demonstrate that the funds in your bank account that you have transferred from Nigeria to the West are legal and yours. So, if you are emigrating and selling off your property in Nigeria, ensure you make sellers write a check or make a Direct Deposit and deposit it into your bank account`. No cash transactions. Create a clear paper trail. If you have funds in your retirement savings account and are leaving employment but not yet aged fifty, you can request up to 25% of your retirement savings account balance from your Pension Fund Administrator. Make sure you pay these funds directly into your account, convert it to $ by buying from the banks and then transferring to the US.

These are the steps to follow.

- Keep a paper trail, no cash transactions. If you receive a cash gift from your parents or employees, ensure you have a letter saying these funds represent a “gift” and will not be paid back. Critical you do these before you travel out.

- Open a bank account in the US. You should open a bank account as soon as possible and use it. Those funds from the sale of your assets in Nigeria, transfer them from your Nigerian bank to your US bank. Invest in a bank product like a Certificate of Deposit and leave it there. You are demonstrating those funds are yours. You do not need to be a legal immigrant to open a bank account. Most US banks will accept an Individual Tax Identification Number (ITIN) from you to open a bank account.

- Get a job; you must get a position to provide verifiable proof of income. If you work for a formal entity, you will be given a paystub and W2; that is easy. If, for instance, you are staying with your “uncle,” get him to employ you and “pay’ you for those menial jobs you do. If you babysit, get paid in check or direct deposit, No cash. Cash does not have a paper trail; checks and Direct bank Deposits leave a verifiable paper trail. If your employer offers a retirement account like a 401k and matches your contribution, you should contribute because you get your employee match and reduce your taxable income. You can also tap into these savings to make a down payment towards your home.

- Pay taxes. You do not need a Social Security number to pay taxes. You can obtain an ITIN and pay taxes. Your tax return is essential because it captures your verifiable income. Most US banks will ask for two years of tax returns from you.

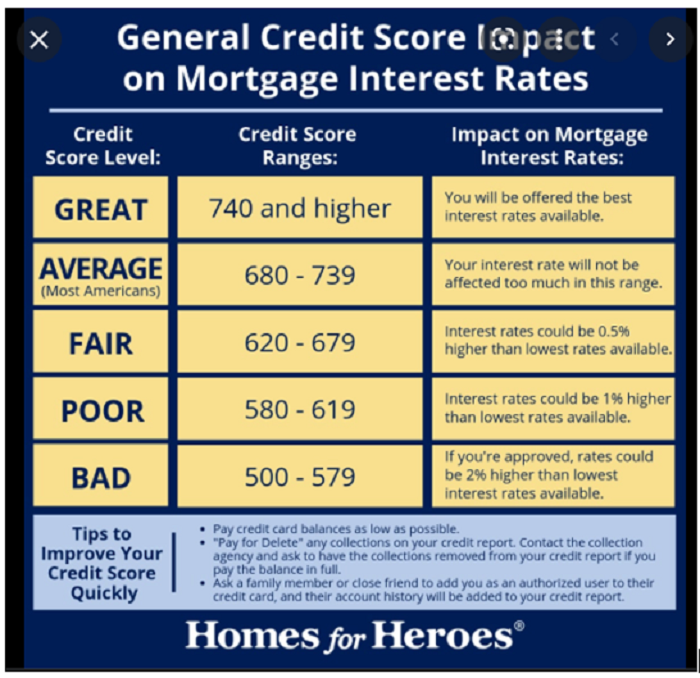

- Apply for credit. The West runs on credit. To get a loan, you need a credit score, but you need a loan to get a good credit score. If you are a new immigrant, you will not qualify for a loan. However, you have options; you can ask your bank for a secured personal loan or credit card. A secured loan means you deposit your funds in the bank and take a loan using that cash deposit as a loan. Request a secured loan if you have deposited your Nigerian Assets sales proceeds. A most secured loan will not pull credit before offering you a loan. When you take a loan, you must pay it back on or before the pay backdate of your loan. Getting a loan means you can then start to build your credit, Credit scores begin from 450 to 850, and there are four-credit bureaus. Your payment history and, unfortunately, delinquencies are reported to the bureaus when you take any loan. The more consistent and on time you repay your loan, the higher your credit score, all things being equal. Your target is to get a minimum score of seven hundred. The higher your credit score, the low the cost of any loan you take, as expressed in the APR. If you have a credit card, it is ok to max it out, but by the cycle date end when you are to repay, ensure your card balance is rough back to a maximum of 30% of line unitized.

Diagram two from Homes for Hero’s shows credit scores and impact on the interest rates you will be charged to buy a home

Diagram 2: Credit Score

Let us summarize if you follow this plan in 24 months, you have

- Assets from Nigeria in a bank account

- A new US bank account

- A Job with a verifiable means of income

- Two years tax returns

- Credit score for two years.

After doing all five steps above, you approach your bank to request to be preapproved for a loan to buy a home. Some points to note. As a first-time homebuyer, you can put a lower amount down as a down payment for a home. However, if you pay less than 20% as a down payment for a home, you may be required to buy Primary Mortgage Insurance (PMI) which adds to the cost of your loan.

In buying a home, always work with professionals and seek advice on the location of your home. Location and affordability are critical determinants for a location to choose from. If you have kids, selecting a home in a school district is also important. Remember that not all areas in America have a property that is appreciated.

In closing, rent and mortgage are both cash streams away from you; paying an agent does not build you any equity; paying a mortgage does. If you get a mortgage in a good area that is less or equal to your rent, that is good.

Source: nairametrics