Nigeria’s equities market looks set to end the first quarter (Q1) of 2022 on a good note due largely to record buy-side interest in outperformers, including stocks like Academy Press Plc, Learn Africa Plc, SCOA Nigeria Plc, Guinness Nigeria Plc, Seplat Energy Plc, and PZ Cussons Plc.

The market cruises north with a positive return of 9.94 percent year-to-date as of Friday, and there are just four more trading days to the end of Q1.

“We expect to see the last of Q1 rallies as investors will purchase stocks for remaining on the register for dividend payments,” said Lagos-based United Capital analysts in a recent note.

At the start of this year, BusinessDay showcased some of analysts’ stock picks for 2022, most of which investors seeking both capital appreciation and impressive dividend yields were advised to buy, notwithstanding some clear risks to market rally.

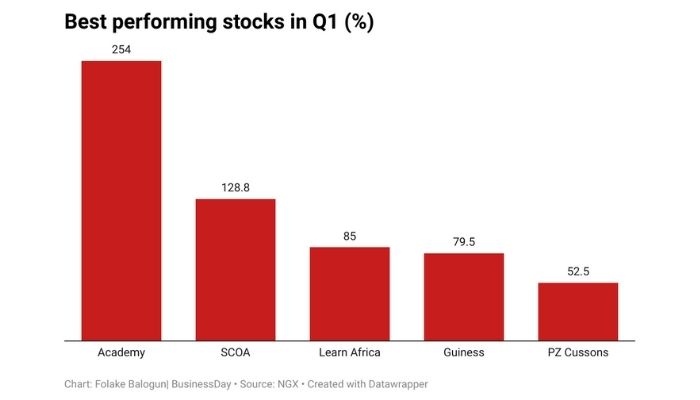

Academy Press, which leads the pack of first-quarter top outperformers on the Nigerian Exchange Limited (NGX), has risen by 254 percent from 50kobo at the beginning of the year to N1.77 as at Friday, March 25, 2022.

SCOA Nigeria, which closed at N2.38 per share on Friday, is among the top advancers so far this year, having risen by 128.8 percent from N1.04 at the beginning of this year.

Learn Africa, another stock on the services subsector of the NGX, has risen by 85.5 percent to N2.17 from its year-open low of N1.17. The N133 per share which Presco Plc exchanged as at Friday represents 51.5 percent increase from the N87.80 it opened at on the first trading day of this year.

At N70 per share, Guinness Nigeria has advanced 79.5 percent this year from its year-open low of N39 per share. Seplat Energy, which opened the year at N650 per share, has risen by 43.1 percent to N930 per share, as investors continued to position in the energy company for higher returns as crude oil price rallies.

PZ Cussons, which stood at N9.30 per share on March 25, has risen this year by 52.5 percent from N6.10 at the beginning of the year; while Royal Exchange Plc, which opened for trading this year at 80 kobo per share, has risen to N1.21 per share, representing an increase of 37.5 percent.

Other stocks that have impressed the market are Ecobank Transnational Incorporated, which rose by 31 percent; Fidson Healthcare (31 percent); FCMB (11.7 percent); Fidelity Bank (29.4 percent), Union Bank (9.3 percent), Zenith Bank (seven percent), and Jaiz Bank (17.9 percent).

BUA Cement has gained 5.5 percent this year; Dangote Cement, 6.4 percent; Meyer, 19.6 percent; Flour Mills, 9.3 percent; Northern Nigeria Flour Mills, 25 percent; Conoil, 12.3 percent; Oando, 13.1 percent; TotalEnergies, 19.4 percent; Transcorp, 11.5 percent; and UACN, 23.2 percent.

In January, BUA Foods Plc listed its 18 billion units at N40 per share, which added about N720 billion to market valuation. The value of Nigeria’s stock market has risen by about N2.13trillion so far this year.

The NGX All-Share Index rose to 46,964.23 points on Friday from a low of 42,716.44 points as at December 31, 2021. The value of listed stocks on the NGX increased from year-open low of N23.183 trillion to N25.311trillion as of March 25.

Analysts at Lagos-based Financial Derivatives Company said Nigerian equities would remain popular among investors as yields in the fixed income space decline and inflation continues its upward trend.

The analysts, in their presentation at Lagos Business School March breakfast meeting, said investors would buy into fundamentally strong stocks with attractive valuations in a post-election year.

“Oil and gas sector will continue its gaining streak, which will be bolstered by soaring oil prices. FX availability will improve cost margins of sensitive sectors,” they said.

On the downside, they see the stock market being sensitive to economic and political vulnerabilities, even as they expect the increased cost of borrowing to further reduce the profitability of listed companies.

“Banking stocks will gather weak sentiment, driven by the elimination of tax shelter while reduced profitability is likely to hurt dividend pay-outs,” the FDC analysts added.

Other advancers are Cornerstone (26.1 percent), United Capital (25.8 percent), Julius Berger (18.6 percent), May & Baker (9.5 percent), and Airtel Africa (31.9 percent).

In their 2022 economic outlook, titled ‘Navigating stormy Seas,’ United Capital analysts said that from their analysis of the current investment and economic climate, “we struggle to see significant improvement in investor appetite towards equity instruments in 2022.”

They said, “We expect foreign portfolio investments in equities will remain downbeat, given the unrelenting FX debacle, upcoming elections, and volatile macroeconomic environment. Given the expected higher yield environment, we anticipate that this will trigger asset rotation from Pension Fund Administrators, which could depress equity market performance.

“Thus, we expect to see sell pressures from domestic investors (particularly institutional investors). Despite the sell anticipated pressures during the year, we do not foresee a rout but rather mild bearish sentiments in 2022.”

Stock investors have continued to trade in line with the companies’ earnings scorecard as many position to qualify for corporate actions like dividends. Investors need to diversify their portfolios to reap higher returns in stocks. This was emphasised at a recent retail investor’s workshop by the NGX and ARM Securities Limited.

“Just imagine what would happen if you invested all your money in a single security. Everything would be great as long as the stock’s performance is good. But in case where the market takes a sudden U-turn, the likelihood of significant loss of investments is increased,” Jude Chiemeka, divisional head, trading business at NGX, said at the workshop.

According to him, the fundamental purpose of portfolio diversification is to minimise the risk on your investments, specifically unsystematic risk.

“This risk of significant loss is further compounded if the stocks belonged to the same sector like manufacturing because any news publication or information that affects the performance of one manufacturing stock could as well affect the other stocks in a similar way,” he added.

BusinessDay