The launch of the online portal of the National Housing Scheme seems to have garnered a lot of interest from Nigerians, as the federal government hopes to close the housing deficit gap across the country.

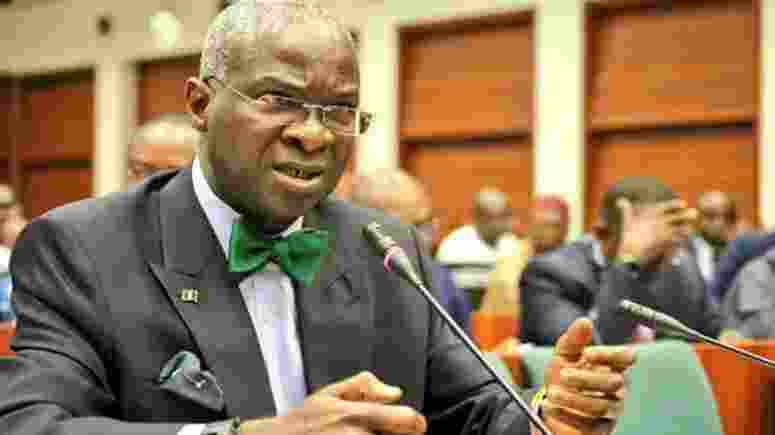

In this exclusive interview with Nairametrics, the Honourable Minister of Works and Housing, Mr Babatunde Raji Fashola talks to Faith Dafe-Joseph about the benefits of the housing programme.

Speaking quite frankly, the former Lagos State Governor addressed key issues around tolling, tax credits, road infrastructure and of course, the federal government’s frequent borrowings. Excerpts:

- Tell us about the national housing portal, how it works, how people can apply and how it can serve people better

If you enter: nhp.worksandhousing.gov.ng on your search engine, it will take you to the portal. It will show you all the houses in the 34 states, the prices, photographs of the exterior and the interior. It will also show you short clips of videos that can give you a tour of what the inside looks like. So that informs you as best as possible what you are buying without necessarily going to the site, but nothing stops you from going to the site. You then fill a form online and attach certain documents, a photograph, an identification document like a national identity card, driver’s license or international passport. At some stage, we might need you to provide some security documents but that is at another stage entirely. You will then choose which type of house you want and where. You will also indicate how you want to pay, whether it is by mortgage, single payment or rent to own. The portal is interactive so you can learn as you go. There’s also an administrative charge to process applications.

- In the past, you have disputed the housing deficit figure. Have you now figured out a number yourself that you think is correct?

No, I can’t conjure up a number. The last census we had was in 2006, 15years ago, so how will I know the number? I am saying we should stop making policies on a number that is not based on data.

- How easy is it to plan when you don’t know the number of deficits we have?

It is not my responsibility to determine without a census. There’s a ministry in charge of national planning. Until we do the census, then we can get a sense of what is the actual need. The absence of definitive data is not justification for working with patently unsustainable data. The absence of one does not support the choice of a totally baseless one. Let me move that forward, building alone is not the only way to end the housing shortage no matter what the figure may be. So this fixation about the deficit, about the number that needs to be built is an incomplete approach to the real view. We haven’t collected data about the number of people who want to own their own house. We have household data. There’s a household survey the national bureau of statistics does so we know there are about 40 million-plus households, so we know how many families, people who occupy a house, we have that. How many are in rent? how many want to buy? These are the things we need to disaggregate. We need to be more detailed on the data we extract. We can’t assume every single Nigerian wants to buy a house.

- This latest stage in the scheme has 5000 houses completed in 34 states and the FCT, how many do you expect to be ready yearly?

We are a federation with 3 levels of government. The state government is responsible for land which is a very important component of housing. The federal government does not own land. The bigger responsibility for providing housing lies with the person that has the bigger share of the resources. Even with the best effort of the state and many of them are investing in housing, you still need the private sector to deliver housing. It is a product. What the federal government will continue to do is modelling, helping the private sector determine what kind of houses can sell well.

- I saw an interview where you said that the private sector has its limitations and it’s not everything the private sector can take over. So where do you think they come in here?

I was making a distinction between the kind of business the private sector is better suited to do, and they are better suited to do housing if they have the knowledge because the rewards are quicker, the investments are not that massive. Unlike, trying to build a road of 370km that cost over N300 billion. Roads, rail tracks are social assets and they don’t often yield enough or full revenue, therefore it is not always commercially viable for the private sector, they must make profit.

The profit of the government is the prosperity of its people. If the government focuses on roads, property value rises and the private sector can build houses and make a profit. You can’t expect the private sector to solve all the developmental problems, they can solve some that is suited to their budget and commercial focus. The federal government should focus on social infrastructure. That is why they talk about the federal government providing an enabling environment all over the world. Our job now as a policy ministry is to make more comfortable fiscal policies, monetary policies, longer-term funding for housing, lower interest rates, and ease of doing business. These can release the energy we are already beginning to see and get more people into play.

- One of the problems for commercial mortgages is the high-interest rate. The federal mortgage has a lower interest rate but the limit, when you consider inflation, doesn’t make it very viable. Is there any plan to lift the limit beyond N15 million?

It can be as big as the pot. The federal mortgage bank makes its money from people’s contributions and we are targeting increasing the number of contributions. We are targeting the private sector and the informal sector. Anyone self-employed can also open an account. As the stock of resources increase, the versatility of what we can do with it is dynamic and we can respond appropriately. But before this administration, whether you applied for N5 million or N15 million, you needed to pay a down payment of 15-20% equity, for those doing N5 million and below mortgage application, we have removed the requirement for equity contribution, for those who are doing upwards of N5 million, we reduced it from 30% to 15%. All of these are measures to make it more affordable and there’s more that we can do but we don’t want to have an unsustainable fund.

- Major urban cities have empty houses, empty estates. The ICPC boss has alleged most of these empty houses are used for money laundering activities. Is there a way to deal with this issue of empty houses all over the country?

These are not govt houses. Planning approvals is not a federal responsibility. State governments have a responsibility and they issue building permits. There are conditions for issuance of C of O across Nigeria that you should build within a certain number of years. One of the ways I will recommend, as this is a state matter, is to put an occupational condition that your house must be occupied within one year. Unoccupied and abandoned houses are nesting places for criminals and proceeds of crime. So subnational governments can ensure they reduce the number of empty, uncompleted and abandoned houses that litter the urban centres.

- Property tax has been suggested, what do you think about that?

It is not something to take off the table but what are you taxing, lack of occupation? I would like to hear more about it because I know property tax is already being paid in some states. It comes under tenement rates, ground rents. It is consolidated in my state, Lagos, as the land use charge. I would like to see the proposals. It is not something I have given any thought to but just talking to you, the only thing I can probably see is to increase the rate so that you can have exorbitantly discriminatory rates for unoccupied buildings and much lower rates for occupied buildings.

- You have been advocating for monthly rents since you were governor of Lagos State. Appealing to the goodwill of people hasn’t paid off, what do you intend to do to move that forward?

One thing that can happen is rent control. It is already happening in Lagos state and I hope it finds appeal with other states. This is not a federal government responsibility, it is a state matter. Not every state has this problem mind you. But for states where it is happening, I would expect state houses of assembly to find it a worthwhile cause to use it to help their constituents. If a lawmaker talks to his constituents, he will know how scared they are when rent is due. If you can take that off the neck of constituents, I will vote for that person. Again, the law is one thing, voluntary action is more compelling. I will continue to make the argument because everyone including the landlord benefits from it, it will bring down the cost of goods and services. The ripple effect on our economy has not been truly measured. We all pay it but immediately I pay someone 2 years in advance, I’m looking for how to make it back and we are passing the cost round. I sense that this can bring down tension in our economy, food prices may come down because of it. It can make inflation come down. But it is not something the federal govt can just pass a law.

You just came with all the problems, you didn’t even commend us for all we have done, over 5000 houses, federal mortgage bank, over 6000 houses, FHA too. That didn’t exist before we came, just acknowledge it, we have moved the needle. It is better than what we met.

- Okay, but how transparent is it?

Go on to the portal, that’s the reason for the portal. I don’t want anyone selling forms, holding forms, I’m not saying they will, but I just want to eliminate it. I don’t want petitions, just go to the portal. This is my experience from Lagos where I came from, where the portal worked and people got 200 houses every month for 3 years till I left. That’s is transparency.

- Let’s talk about roads and the different ways of funding road infrastructure in the country. You proposed a bill for a special intervention fund for emergency rehabilitation and maintenance. Can you tell us a bit more about that?

Climate change. We have accepted the science. Every year, we will have natural disasters, emergencies. Some of the roads and bridges we are using now were built over 40 years or less ago. At the time, the measure and the predictions and the data that informed the design, the levels of the flow of rivers that informed the design have all changed, rivers are running off course where they should be running directly under the piers. Because the volume is high, it’s disrupting traffic and livelihoods. Apart from the funding in the budget for building, my advocacy was that we must have an emergency fund to be able to rapidly respond to those disasters when they happen. I acknowledge that there’s provision for emergency procurement in the law but contractors won’t move because they have to buy materials from suppliers and if they don’t see a budgetary provision, they are usually reluctant to respond and that lengthens the number of days by which we can bring relief to people who are cut off. We are waiting for the appropriation to come, we have defended the budget, we have made the case and we hope there will be a positive response from parliament.

- Still talking about funding for roads, there’s been a report on tolls reappearing, how soon is that going to happen?

We are trying to concession 12 roads. We put 12 roads up and we’ve prequalified those who have local and international partners. Out of 75, we prequalified 18 who we think can do it because they need to raise capital. For them to be able to make a business case which is the next stage, they need to develop a financial plan. We developed a national tolling policy which was approved by the council. That policy then guides how they make their plan. They will know they can’t charge military vehicles, they can’t charge bicycles, they can’t charge paramilitary vehicles, they can’t charge tricycles. They will know what different vehicles can pay as indicated by the policy. That document is out now and we are waiting for them to send us their proposals.

- What do you say to arguments that tolling will be double taxation on the people?

Don’t listen to those arguments. Taxes are levied compulsorily by statutes. You can’t levy taxes without a law. Tolling is a user charge. If you don’t use the road, you don’t pay for it. Also, there are administrative charges. If you want the government to process certain documents because you want certain services from the government, then the government is entitled to ask you for charges. We can’t use all of the taxpayers’ money to provide a unique service for you because not everyone wants that service. We must distinguish between a tax and an administrative cost or user charge like tolls.

- It was reported that the FIRS is also proposing a road tax called the road infrastructure tax, do you know about that?

I haven’t seen the details so I can’t comment on it.

- What about tax credits, any thoughts on that?

Tax credits are a welcome development. It is an expansion of an existing policy, by the Buhari administration. You can see the impact of tax credits on the Apapa to Oworonsoki, Lagos ports, Obajana ports, Lafarge road and Bonny. We have put up tax credits for 21 additional roads to be built by the NNPC. These tax credits are revenue to come to the government. The policy just asks the person liable to pay the tax to bring the money in advance so we can use it to fund roads or any other infrastructure. The condition is that the eligible infrastructure must be one that members of the public have access to. Companies that use them, use them in places where their businesses are affected, the government should build the road to their businesses but when the government is not able to do so quickly enough, then they can build the roads but members of the public also use the roads.

- You are advocating a pause on new projects, can we talk about that?

Isn’t that sensible? Let’s slow down, let’s finish. We are in a season of completion, our tenure is winding down, and we are connecting the last dots on our projects so that people can see because sometimes, perception and reality need to converge.

- Let’s talk about borrowings. There’s a Sukuk bond of N250 billion to be raised for road infrastructure. Last year you raised a Sukuk bond of about N162 billion as well.

As long as the borrowing plan in the medium-term expenditure framework and fiscal strategy document contemplates and accommodates the borrowings, as long as it is consistent with the national assembly’s view of what is tolerant and compliant borrowing, certainly. Given what we have to do and the work that needs to be done, this conversation that we are borrowing too much but no one has said, drop this or don’t build this house or don’t discharge this responsibility or come and tax me more, so where is the government supposed to find the money? I am not dismissive of the concerns on borrowing, but these are borrowings for investment and not for consumption.

Unfortunately, we missed a window when oil was trading at over a $100 per barrel. That’s when we should have invested these monies, but we didn’t do it. The needs are not going to go away, those who need those services are not diminishing. On the contrary, they are increasing. If you want those services, you either put your voice behind increased taxation which you will not do or sensible borrowing.

- Oil is up again, almost $85 per barrel and projections are that it will go higher

The oil conundrum brings its challenges and I’m not the oil minister, if the price of oil goes up, what do you expect to happen to oil products? But somehow this government is keeping these products at the same price so that’s where some of the money has to go because the elephant in the room is how to benefit from oil price rises and keep oil byproducts at a lower price.

- That is the same subsidy argument the other administration you are talking about could make too

That’s why I said it’s the big elephant in the room and we have to find an answer to it at some point. But oil prices were not at $80, they were at $140 per barrel at one time and our budget was N4 trillion, we doubled the budget in our first year, 2016, and oil prices dropped to $40 per barrel and we increased the budget to N8 trillion. Now the budget is almost N16 trillion.

source: nairametrics