Quality entry-level property ownership is not only a determinant and driver of household and social welfare, it is also often the largest asset and contributor to economic wealth for most African families. An integral part to building a strong and sustainable middle-class is access to homeownership (land and property rights), which remains limited for the majority of Sub-Saharan Africans. When the secondary market for affordable housing becomes more developed, generational wealth and broader access to the economy becomes possible for people who have been historically under-served.

Recent data from the International Finance Corporation (IFC) indicates that there are 40,000 new people born across African cities daily, many who will experience challenges accessing good quality affordable shelter. Kenya and Nigeria have been identified as high priority countries with an estimated shortfall of 2 million units in Kenya and an incredible 17 million in Nigeria.

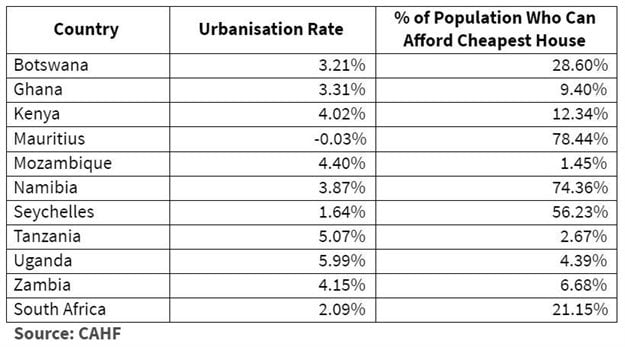

The below table from the Centre for Affordable Housing Finance (CAHF) 2020 Year Book highlights urbanisation rates across the continent:

|

The continent faces challenges in its response to demand that includes land availability, cost (including the prohibitive cost of land which makes it difficult to produce quality products at affordable pricing), access to funding, under-developed mortgage loan environments, access to equity and pre-sale requirements and financing solutions that make sense for all stakeholders.

The World Bank and IFC highlight a lack of debt funding across the continent, pointing out that banks tracked in the West African Monetary Union (WAEMU), which services nations such as Benin, Burkina Faso, Ivory Coast, Mali, Niger, Senegal and Togo, issue an average of 15,000 mortgages per year against demand for approximately 800,000 new units.

PPP framework

As a bank, we believe that we require a public and private sector partnership framework that works to develop sustainable solutions to address housing shortages in the affordable housing ecosystem, which includes:

- Land availability

- Capital availability (debt and equity)

- Skills development

- Data-driven structural reforms

- End-user financing solutions

In respect of access to finance, development funding institutes (DFIs), such as the World Bank, IFC and other organisations, have a mandate to unlock funding for this sector. Banks have an important role to play in championing blended funding models that present the opportunity to unlock home ownership for the ‘under-sheltered’ segment of the population.

Limited data available

One of the biggest challenges that persist in the sector is limited availability of quality, real-time transactional data. Varying availability of data in key select markets impacts important elements such as credit scoring, depth of market, developing bankable funding solutions, project timelines and investor appetite amongst other important levers.

Several Sub-Saharan African markets have designated affordable housing as a strategic sector, earmarking the delivery of housing as a public-sector-led initiative. However, there are challenges to accurately sizing the market and understanding the effective demand, addressing the structural bottlenecks, and taking stock of the housing units produced given the data limitations we face.

Affordable housing is a strategic focus for us as a bank and we look forward to partnering with the supply-side of the market as they identify opportunities in Africa to deliver housing solutions that will allow entry-level property ownership to be more than just a dream.