Among the many problems plaguing the Nigerian populace, shelter happens to be a more biting crisis. At over 17 million in deficit and tens of millions homeless, housing issue in Nigeria has assumed an alarming proportion. COVID-19 came in 2020, crashed economies and deepened the housing crisis among others. In the midst of this, however, the real estate sector is improvising its way around the pandemic and shelter scarcity, to develop creative designs and themes to ameliorate the hardship to provide accommodation for as many as are economically able. The operators are rising above the challenges that are specific to their trade and the larger economy. Chris Paul looks at the industry using the experience and example of Purple Group

Housing in Nigeria, like most of her crisis is dire strait. According to the report titled Address- ing Housing Decit in Nigeria: Issues, Chal- lenges and Prospects, written by Emmanuel

Abolo Moore, a recent study of housing situation in Nigeria put existing housing stock at 23 per 1000 inhabitant.

Currently housing decit in the country stands as at December 2018 is estimated at a whopping 20 million units, which is about 15.0 per cent increase from the gures in anuary 2019.

Funding the decit will require an estimated N21 trillion. With a population of nearly 200 million, the current decit is alarmingly high.

Housing decit in Nigeria, as at 1991, was at seven million and rose to 12 million in 2007, 14 million in 2010 and currently 20 million units.

Growing ahead of general ination, on the other hand, are the costs of houses and rental payments for houses. Making matters worse, the composition of houses for sale and rent in the market has been inexorably shifting towards very expensive houses.

untitled

According to experts only 10 per cent of those, who desire to own a home in Nigeria can af- ford it either by way of purchase or personal construction as against: 72.0 per cent in USA 78.0 per cent in U 60.0 per cent in China 54.0 per cent in orea and 92.0 per cent in Singapore.

In Nigeria, the need for private sector partici- pation that would support the government’s targetisamajorfocusinthe FederalGovernment Economic Sustainability Plan on Mass Housing.

Uplifting millions of people from poverty, as an economic strategy without integrating the housing sector and its entire ecosystem will remain an impossible task for any government.

In 2020, China achieved the development of 15million housing units, which speaks further to the need for the government in Nigeria to explore a robust policy on “Social Housing” that the private sector can key into.

Although, there is adequate data and research in the Nigerian eal Estate and Housing Market abound, accessibility, interpretation and applica- tion remain a challenge. Quality of infrastructure, security, demand and supply are some of the factors that have led to the rising cost of apart- ments and rents across the country.

When COVID-19 disease became a pandemic, it devastatingly disrupted economic activities acrosscommunities,countries,continentsandthe entireworld. Theuniquechallengesfacedin2020 arose from the global pandemic and lockdowns to the unrest, specically that aected Nigeria, recently, that left several businesses gasping for survival. This year has been a steep learning curve for many businesses as it has shown the survival instincts of businesses in the face of unexpected economic disruptions.

For some real estate players like Purple Group, ownersofpurplemarylandandpurplelekki,these challenges have led to a continuous recongura- tion of their capital structure, quick response to market changes and customer/partner changes to the market.

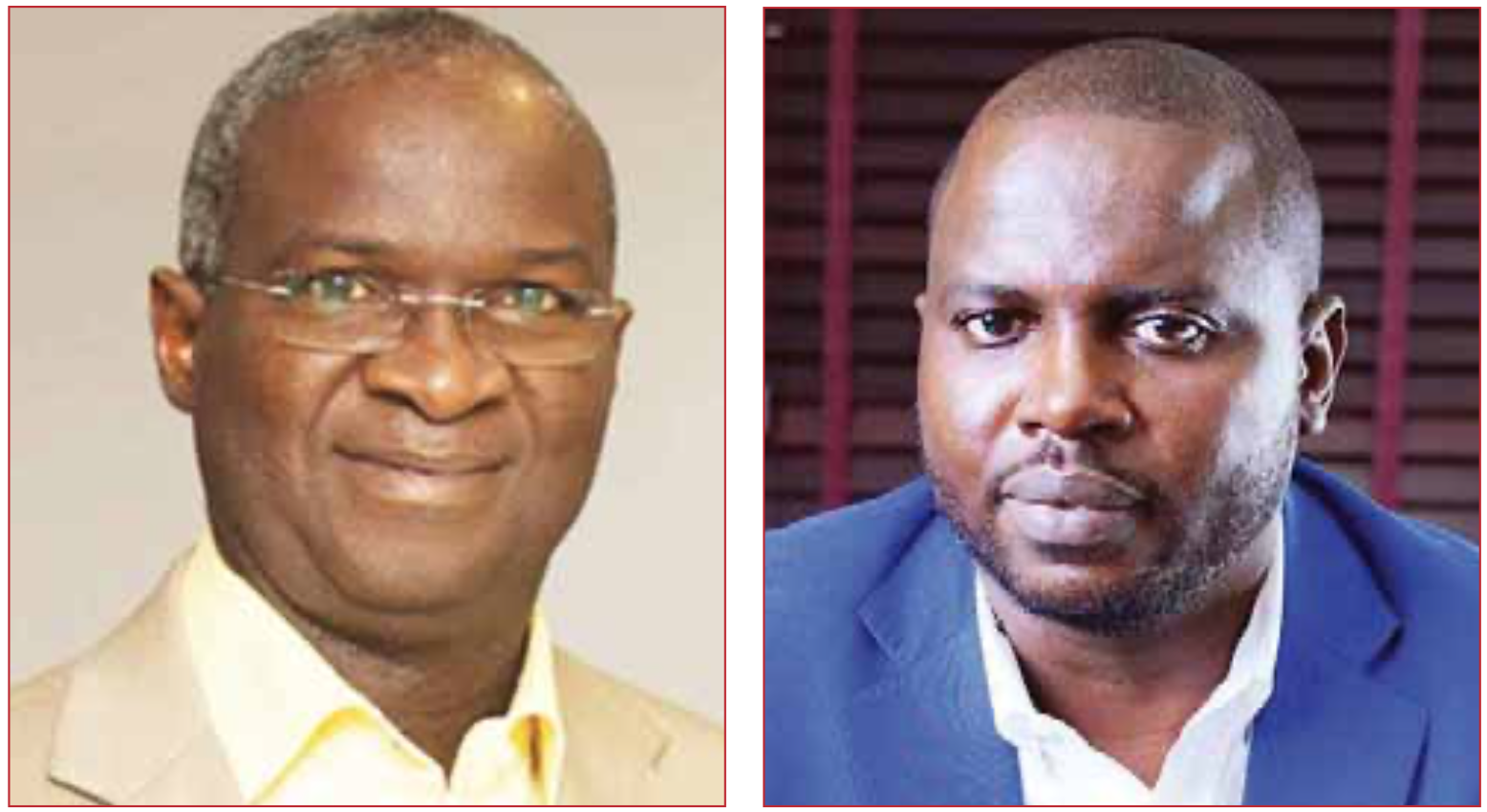

The Purple Group Co-founder and Chief Executive, Laide Agboola, said the organisation has been able to test its products in the worst of market conditions both in 2016 and now in 2020.

“Wecontinuetoworktowardsmaintainingour continuous condence amongst our domestic and international alliances. The questions have remained the same: How do we assure our in- vestors their returns are achievable And, how

untitled

do we deliver on the proposed assets amidst lockdowns and a contracting economy

“Fortunately, our mixed use development products have been designed, specically, for this market, based on deep research analysis and as a response to the market both in 2016 and now validated as the appropriate product for our Nigerian market even in 2020,” he said.

According to him, Purple’s relationship with its tenants/partners and the growth of their busi- nesses remain paramount to the operators. This, he said, has made those partners remain with the company despite the several economic issues.

“We have continuously prioritised brand awareness, our product and partner products awareness and marketing with an unusually lower priced rental regime derived from our lower priced building strategy supported by smaller t for purpose spatial planning.

This has been our strategy in maintaining our 97 per cent occupancy level. Albeit, this has not been without some sort of grant period in 2020. It has been an unusual year and has required us to deliver unusual responses tailor-made across our partners to arrive at sustainable businesses within our build environment going forward. This also speaks to the resilience of the busi- nesses within our centre. However, this year has also reinforced our belief in our mixed use retail strategy, focusing on essential services and domestic retailers, who are exible and have shown adaptability to the peculiarities of the Nigerian Market,” said Agboola.

nown as a property development company, Purple has seen numerous shifts in the past few years, from the rise of shared spaces and services bringing about co-working and co-living to this year, which Agboola said, “has also shown us the value of mixed use assets, but also a need for privacy and self-sustainability.”

“We believe there is gradual shift towards smaller, mixed used facilities that give customers some sort of balanced, but aordable and exible lifestyle. This is the immediate future of real estate anditiswhatourpurplenanoproductlinebrings to complement our purplelekki and eventu- ally would complement our purplemaryland (formerly Maryland mall) product oerings. The drive is to be able to deliver on work, shop, eat, play, drink and live concept across our product oerings and back it up with a strong online marketplace, purple.shop,” he explained.

For us as a lifestyle and real estate develop- ment business, the ability to deliver products to customers and partners at sustainably attractive

untitled

prices should be a major priority for a smart real estate player.

The Purple CEO noted that prior to a lower interest rate regime currently being experienced, attractive naira-based nancing for real estate lifestyle especially around hospitality had not been entirely forthcoming.

“We also need supportive policies and eco- nomic laws to ensure we are all driving towards resolving shelter decits in every form whether it be residential or hospitality.

“There is obviously an infrastructural gap that can only be driven by investors.

“This is even more apparent now than ever with the collapse of the oil price coupled with the pandemic, we can feel the need for domestic players and institutions to back leading domes- tic players that have boots on the ground and neck deep in the development cycle of our dear country, Nigeria.

“We are not a portfolio international company or investor. We are Nigerians and we are on the ground. Our focus is to develop Nigeria, but Nigeria must provide an investment climate that is evidently supportive of growth so as the domestic players and institutions do not shy away from investing locally especially at a time like this. We are all we have. Our target is to continuously work on delivering value assets to our customers and partners at attractive prices irrespective of the exchange rate movements experienced.

“Thesemovementsformathreattoourmargins created from lower interest rate regimes as our ultimate plan is not to continuously pass on this exchange rate changes in our lifestyle develop- ments to our consumers,” Agboola said.

Besides development challenges, there are operational challenges bottlenecks such as cost of power, good access roads and other infrastructural decits, meaning developers have to bear these costs.

“We are very mindful about pricing and continuous increase in prices in a down market. Our ability to sell or lease products at attractive prices can only be sustained where we do not have variables moving constantly. With the current economic recession as well as reduced spending power, real estate tends to be seen as luxury rather than an investment. We bank on the fact that the pandemic has shown the real importance of work, shop, eat play, drink, live in a singular location. However, this must be at the right price point.

“Material sourcing and a weak domestic

untitled

manufacturing industry continues to be a stretch on right product pricing for the domestic market, as appropriate items continually have to be sourced oshore.

“This coupled with the downward direction of the Naira continues to increase the cost of developments, limiting developers in terms of nishing and nance to innovate further.

“Notwithstanding, we continue to innovate and form alliances with our network of contrac- tors, building partnerships that align our interest of delivering value to our consumers based on attractive pricing,” he said.

In terms of development and operations, Purple found a way to work with the best of the domestic space it operates in whilst delivering international standard t-for-purpose assets.

Agboola said We need to ensure we are not losing our best hands at all levels of the real estate value chain to the Diaspora. Taking on international expertise at greater cost is at the detriment of the Nigerian eal Estate develop- ment Industry and can only lead to stagnation if the best minds and artisans are brought in and never home grown.”

Recent economic development in Nigeria has made investors to be wary, indicating that the condence level in the country’s policy environment and in the markets needs to be rebuilt. Fortunately, he said, Purple’s product oerings work for its partners, pointing out that, “Our short, long and residential product are essentials. We have witnessed a signicant o-take despite the turbulence associated with 2020. For Purple, we continue to build condence that our investors have in us.

Our plan is to continuously deliver value to them. We aimed to remain liquid prior to the pandemic whilst restructuring our books.

“We are achieving that via a combination of a secondroundofequityinvestmentachievedinthe chaotic year of 2020 plus additional domestic debt funding for our expansionary activities within the essential space despite market conditions.”

Purple’s residential developments are a func- tion of co-habitation principle towards real estate asset classes in the rst instance let alone the multiuse as aparthotels, short and long stay as well as co-living.

“The concepts discussed here are alien and somewhat new to the market, but the market must adapt. We had conducted that research as far back as 2018 and began our quest for delivery ever since then.

We are here now. The quest to create unique, but yet attractively priced living solutions for the mid-market, a discerning investor’s haven,” he said.

In a post-pandemic era, values that include perseverance, audacity, collaboration and transparency are features that will distinguish innovative players in the sector. “Although these principles have guided us thus far, we have only just better dened these such that our end users feel the purple way. We want to ensure our investors also remain very much at the centre of all we do as a business. With our new products, we are only ensuring that we oer our investors a diversied portfolio that enhances better returns.

“Nanos will feature top tier hotel management services.

“Merging this hotel management approach with a residential style building has created a unique well catered experience for occupiers as well as a viable professionally managed asset for investors who are able to receive an assured tenancy return for these nanos at purplelekki, only where they choose to.

Source: This Day