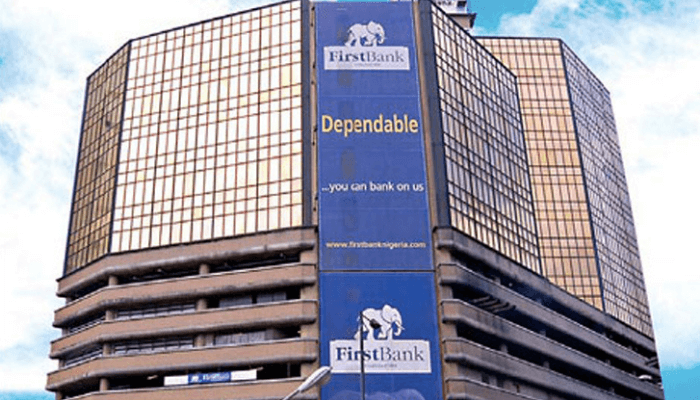

First Bank of Nigeria has given debtors whose obligations have fallen due and remain unpaid till March 19, 2021, to liquidate their indebtedness to the bank or face public disgrace by way of publishing their names in newspapers this month.

This was contained in a statement to customers signed by the management.

The bank’s planned action is in line with the Central Bank of Nigeria‘s directive on the recovery of delinquent credit facilities.

In 2015, the CBN issued a directive to all banks and discount houses (Merchant Banks) in the country to give the delinquent debtors three months of grace to turn their accounts from non-performing to performing status, and to publish the list of delinquent debtors that remain non-performing in at least three national daily newspapers quarterly.

In addition to the publication of the names of the debtors, the bank said the CBN will impose further sanctions on the debtors, including a ban from participating in the Nigerian foreign exchange and government securities markets.

Read Also: COVID-19: CBN’s intervention policies saved banking sector

These sanctions on the debtors will not impede other sanctions that FirstBank is currently taking or may choose to take to recover the loans from the debtors.

“All affected customers should immediately settle their indebtedness to the bank,” said the statement seen by BusinessDay.

“in line with the CBN directive our quarter 1 2021, the publication of delinquent debtors on our books in BusinessDay and three other National Newspapers is scheduled for March 2021, please be informed that the publication will include the names of the directors, subsidiaries, persons and entities related to the delinquent debtors,” it said.