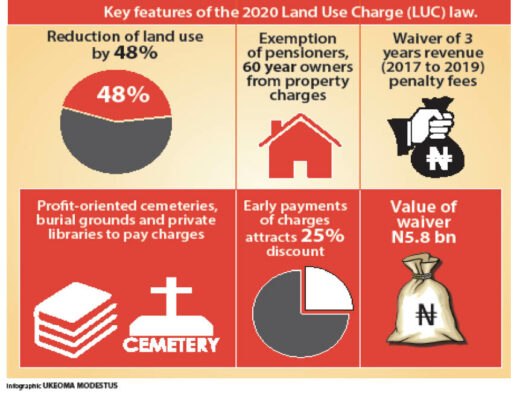

Lagos State government last week released provisions in the new 2020 Land Use Charge (LUC) law, which led to the government forfeiting N5.8 billion in earned revenue from penalties.

The law also reduced default penalty charges, and exempted certain people from paying charges.

In this piece, our reporters dissect the prospects for this pronouncement.

The Lagos Commissioner of Finance, Dr Rabiu Olowo, who presented the guidelines recently, said in 2018, there was an increase in the LUC and the valuation method for properties.

“In view of the aforementioned, the current administration decided to review the LUC law by reversing the rate of Land Use Charge to pre-2018 while upholding the 2018 method of valuation,” he stated.

Pensioners exempted from charges

According to the new law, all property owned and occupied by pensioners are exempted from paying the LUC. This covers all retirees from private and public institutions in the state or any person that has attained the age of 60, and has ceased to be actively engaged in any activity or business for remuneration.

However, profit-oriented cemeteries and burial grounds as well as private libraries are no longer exempted from payment of the LUC, as it was in the past.

Rates crash by 48%, 3yr penalties waived

The law also caused a 48 percent reduction in the Annual Charge Rates (ACR) which translate to Owner-Occupied Residential Property rate of 0.076% to 0.0394% and Industrial Premises of Manufacturing Concerns rate of 0.256% to 0.132%.

Residential Property/Private School (Owner and 3rd Party) can now pay from 0.256% to 0.132%; Residential Property (Without Owner in residence) could pay 0.76% to 0.394% of the value annually; Commercial property (Used by the occupier for Business Purposes) pay 0.76% to 0.394%, and Vacant Properties and Open Empty Land pay 0.076% to 0.0394%.

The ACR for agricultural land was reduced from 0.076% to 0.01%, indicating 87% reduction from the 2018 rate, and an incentive for farming.

The 2020 LUC law also introduced a 10% and 20% special relief for vacant properties and open empty lands.

Penalties for the LUC Land for 2017, 2018 and 2019 were also waived. This translates to N5.752bn potential revenue that has been forfeited by the state.

Commenting further, Olowo said, “While the state hopes for the return of normalcy to business activities, it is important to let residents know that the payment of LUC is not intended to inflict any hardship on anyone.”

Landlords, others react

Some landlords in the state as well as other experts have reacted to the development with some of them pleading with the government to waive the LUC levied on their property this year due to the hardship caused by the COVID-19 pandemic.

A landlord in Idimu, Mr A. Ojabanjo, said COVID-19 has led to job losses, increase in poverty and inability of tenants to pay their landlords.

“With the present situation in the country, many have no job, so they should lift the payment of LUC till 2021. They should put it on hold,” he urged.

Another landlord in Shangisha, Mr Haruna Adeshina, said he was yet to understand the reduction percentage and how it would lead to a reduced LUC for him. “We don’t understand what it takes yet, but with time we will. Truly, it may affect house rent but, that cannot be certain until we see the bill.”

Bar. Moses Obiro, also a landlord, said it will check the excesses of landlords that hide under Land Use to increase rents of tenants.

“It is a new lease of life for landlords who are under financial stress.”

He advised other state governments to borrow a leaf from the Lagos State land use laws in order to develop their states.

A legal luminary, Dr. Bunmi Bewaji, said the development would bring more money to the pockets of property owners. “If at all there would be an upward review, it should be a gradual one like N1000 annual increment which would not cause much drain on the property owners,” he said about the 2018 LUC increment.

A chartered accountant, Lawrence Akande, said the LUC 2020 was fairer than the previous one. “The most interesting is the 25 percent discount to be given to those who make payments before the due date which is what the government wants to encourage,” he noted.

A fellow of the Institute of Chartered Accountants of Nigeria (ICAN) and the Chartered Institute of Taxation of Nigeria (CITN), Mustapha Olanrewaju, said the reform was capable of increasing the IGR of Lagos as well as capturing more taxpayers into the tax net.”

“Organisations that are into property would go to buy lands that are cheap in rural communities and develop the same into estates which they will sell out to interested buyers. Banks will also smile as more corporate organisations will invest in land,” a Lagos-based property lawyer and human rights activist, Chief Gabriel Giwa-Amu, said.

Source: Daily Trust