Eggheads in the nation’s real estate sector have predicted a marginal growth in the sector occasioned by the crucial roles the Family Home Fund (FHF) and the Nigeria Mortgage Refinance Company (NMRC) are expected to play in ramping up the 20 per cent reduction in the Federal Government’s spending on housing.

Given the present economic and political realities, the new tax regime and compelling trends in the real estate industry, experts said 2020 would perhaps herald the beginning of real growth in the once recessed sector.

According to them, the year would be the beginning of real growth in the sector after the recession of 2015.

The experts, who spoke at the 2020 Nigerian Real Estate Market Outlook breakfast meeting organised by Northcourt Real Estate in Lagos, include professionals in the built environment, policymakers, mortgage bankers and investors.

They noted some economic steps that will drive the growth both on the supply and the demand sides.

According to them, the Finance bill 2019, recently passed by the National Assembly would play a crucial role in the anticipated growth especially with the exemption of Small Medium Enterprises (SMEs) from the tax net.

The Finance Bill, which seeks to change Nigeria’s fiscal laws, they said, would favour Real Estate Investment Trusts (REITs) once operational.

Also, the Federal Government policies on recapitalisation of mortgage banks and insurance companies are expected to create traction in those sectors with great positives for the real estate industry.

Others include the crucial roles; the Family Home Fund (FHF) and The Nigeria Mortgage Refinance Company (NMRC) are expected to play in ramping up the 20 per cent reduction in the Federal Government spending on housing.

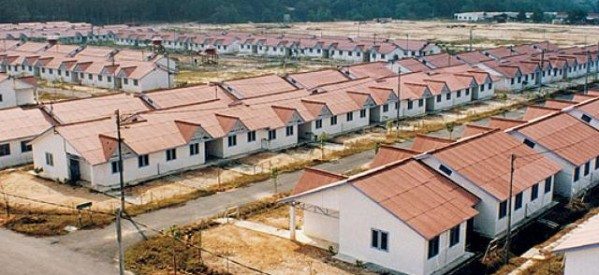

The $2.5bilion FHF, which has commenced residential development projects in Yobe and Akwa Ibom states in partnerships with Mixta Nigeria and Shelter Afrique towards achieving 500,000 homes by 2023 in different states.

Also, the Ministry of Works and housing is considering raising a ₦10 trillion National Infrastructure Bond, which is expected to

bridge funding gaps for infrastructure and housing construction.

However, they stressed the need for the government to come up with legislation that would make affordable or social housing a reality through easy access to land, easier approval process and control access.

The Chief Executive Officer, Craeme Blaque Group, Zeal Akaraiwe, who led discussions at the event noted the Federal Government’s desperation to raise revenue, stressing that it may affect businesses whose tax books are not in order.

Akaraiwe, who spoke on the 2020 economic outlook and effect of the finance bill on the real estate said the speedy passage of the Finance Bill by the lawmakers is an indication of the seriousness to squeeze businesses and the Central Bank of Nigeria’s support which can make the economy more volatile.

Specifically, he said, the Foreign Exchange Subsidy initiated by the CBN to stabilise the Naira, has cost the nation a record $5.5 billion and $6 billion from 2017 to 2019.

According to him, the effect of this coupled with other policies aimed at stabilising the Naira and encouraging direct foreign investment will create a healthy uncertainty in the sector.

Akaraiwe, said with these realities, many businesses would tend to avoid keeping money in Naira, while there will be reasonable pressure on property investment but with a change structure.

The implication, he said, will be an influx of foreigners in the real estate sector because of government’s encouragement on direct foreign investments through efforts on the ease of doing business.

According to him, 2020 throws magnificent opportunities for those who have the guts and liquidity to invest in property markets.

“The volatile, uncertain and complex nature of the economy will provide opportunities for investors who can make fast decisions to simplify and clarify the ambiguity in the environment”, he added.

Source: Guardian

Leave a comment