Atiku, Obi, or Tinubu – Who is better for Nigerian Real Estate?

By Dolapo Omidire

Summary:

In less than 2 months, Nigeria will head to the polls for another landmark election that will result in a leadership transition after President Muhammadu Buhari’s 8-year administration. At Estate Intel, we are particularly keen on understanding what plans African presidential and governorship candidates have for their real estate markets. Consequently, our team has reviewed…

In less than 2 months, Nigeria will head to the polls for another landmark election that will result in a leadership transition after President Muhammadu Buhari’s 8-year administration.

At Estate Intel, we are particularly keen on understanding what plans African presidential and governorship candidates have for their real estate markets. Consequently, our team has reviewed and extracted the relevant real estate policies and plans from the manifestos of the most vocal candidates for a synopsis that will include an overview, our thoughts, and a final summary.

To provide some context, Nigeria’s economic indicators over the past 8 years have been far from great. Rapidly growing inflation – currently at a 17-year high of 21.46% in November 2022; weaker than typical economic growth that has hovered between -1.8% and 3.6%; and a consistently weaker currency that has depreciated by over 125% since 2015. Consequently, 63% of the population have been classified as multidimensionally poor by the Nigerian Bureau of Statistics. While some of the challenges could have been managed with better policy and leadership, it is important to objectively consider external shocks including falling oil prices, COVID-19, and more recently the Russian-Ukraine War that have caused some disruption worldwide.

As the graph above shows, for most of the past decade, the real estate services and construction GDP sectors have been in negative territory. When Nigeria started showing strong positive growth in 2021, both the real estate and construction sectors posted stronger figures. In line with our previous findings that Nigeria’s real estate market amplifies overall GDP performance.

We proceed with our analysis of candidate manifestos in alphabetical order.

Atiku’s ‘Real Estate Manifesto’

Building the Economy of Our Dream for Prosperity

Atiku’s economic agenda has an overarching objective of providing a more hospitable environment for businesses to thrive and create jobs and wealth for Nigerian citizens.

The Atiku Administration proposed 7 Strategic Steps to Implement the Economic Development Agenda.

- Number 2, which is relevant to real estate, involves a plan to Invest to Increase Stock and Improve the Quality of Infrastructure: ‘Our goal shall be to double our infrastructure stock to approximately 70% of GDP by 2030. This quantum leap would require a commitment to invest a minimum of US$35 billion annually in the next 5 years to finance all the core public infrastructure projects. We envisage this will come substantially from the private sector.’

- As part of this, they intend to develop 1 million housing units, which will be private-sector-led and focus on ‘low to medium’ [income] levels.

Parts of their strategy for achieving this are outlined below:

Institutional reforms

- Establish an Infrastructure Development Unit [IDU] in the Presidency, with a coordinating function and a specific mandate of working with the MDAs to fast-track and drive the process of infrastructure development.

- Strengthen the capacity of the ICRC to promote Public Private Partnerships (PPP) in the construction and management of infrastructure across the country

Innovative financing of infrastructure

- Facilitate a review of the financial, legal, and regulatory environment to promote private investment in roads, rail, housing, and power.

- Incentivize, with tax breaks, a consortium of private sector institutions to establish an Infrastructure Debt Fund [IDF] to primarily mobilise domestic and international private resources for the financing and delivery of large infrastructure projects across all the sectors of the economy.

- The IDF will have an initial investment capacity of approximately US$20 billion.

- Create an Infrastructure Development Credit Guarantee Agency to complement the operation of the IDF by de-risking investments in infrastructure to build investor confidence in taking risks and investing capital.

In their plan to drive growth for MSMES, they will:

- Ensure that approvals needed for the creation of new businesses such as land acquisition, property registration, and construction permits are simplified, streamlined, and are not subject to excessively complex bureaucratic procedures.

Estate Intel’s Synopsis Of Atiku’s ‘Real Estate Manifesto’

Atiku the Private Sector Advocate

As a longstanding advocate for greater privatisation, it comes as no surprise that most of Atiku’s plans are centred around private sector reliance. These include public-private partnerships, tax incentive systems, and tapping into the debt capital market. In an environment riddled with corruption and leakage, a smaller government that can rely on some of the efficiency seen within the private sector will be a step in the right direction.

Ambitious 1 Million Housing Unit Target – What’s the strategy?

With private sector support, Atiku expects that he will be able to deliver 1M housing units during his tenure. Outside of the institutional reforms and innovation financing of infrastructure outlined above, there is not much additional colour on how this will be achieved. This presents a problem, as similar audacious housing targets with relatively similar execution strategies that have been set in the past have failed to materialise.

Exciting Infrastructure Investment focus with a risk of Duplicated Efforts

- The creation of a specific Infrastructure Development Unit within the presidency will provide the required focus for the execution of much-needed road, rail, housing, and power. The manifesto, however, fails to provide greater detail on how this will differ from the existing Ministry of Works, Housing and Power. Without that, we might be left with the same institution and a new name or even worse, two governmental institutions doing the same thing.

- In the same vein, the Infrastructure Debt Fund outlined in the plans sounds particularly similar to the InfraCredit, the Development Bank of Nigeria, and more specifically, the Central Bank of Nigeria’s N15trn Infrastructure Fund called InfraCorp Plc. InfraCorp was announced in 2021 to be run with help from the African Finance Corporation and the Nigerian Sovereign Investment Authority. The intention was to address Nigeria’s infrastructure deficit and boost funding for capital projects. However, not much activity has occurred since the announcement.

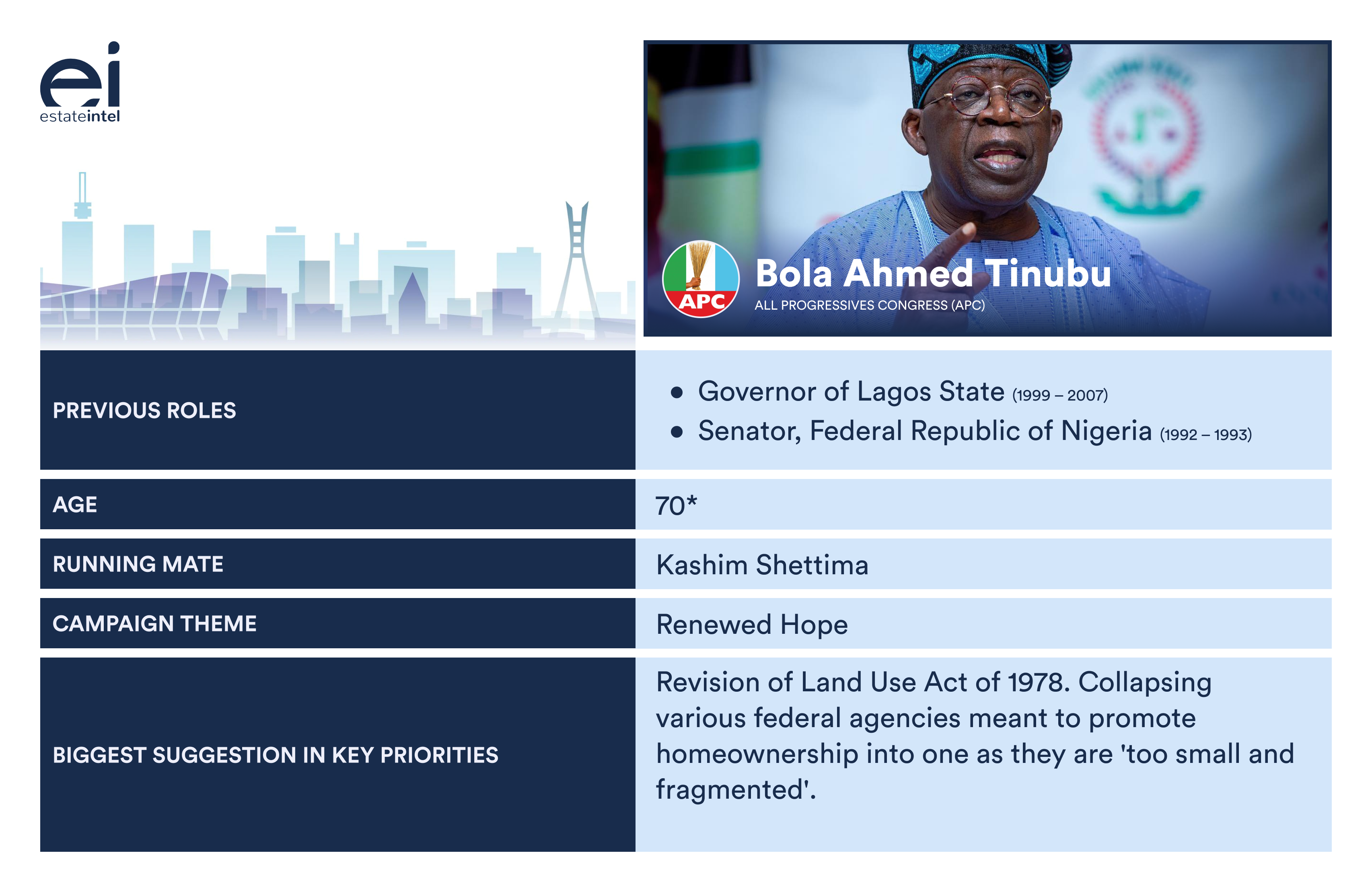

Tinubu’s ‘Real Estate Manifesto’

Mortgage and Consumer Credit Reform

- The various federal agencies meant to promote homeownership are too small and fragmented. To address the housing deficit, Tinubu plans to ensure greater cohesion and efficiency by merging these agencies into a new, more competent body. This new entity will inherit the functions of existing housing authorities and shall be adequately capitalised by the Federal Government.

- The agency will have a three-fold mandate to (i) grant low-interest-rate mortgages directly; (ii) guarantee qualified mortgages issued by banks; and (iii) purchase mortgages from private banks.

- The guaranteeing and purchasing of mortgages will incentivise banks towards mortgage lending and will deepen the secondary mortgage market.

- Banks will also be encouraged to engage much more in the provision of affordable consumer loans for automobiles and expensive domestic appliances. A certain portion of bank lending must be earmarked for the consumer. All non-compliant banks will pay a penalty to the government. Compliant banks will be entitled to tax breaks and credits as well as favourable treatment by the CBN regarding inter-bank transactions and other monetary policy ratios.

Home Ownership

- Homeownership is a source of prosperity, social stability, and individual pride. A vibrant residential construction industry is essential to a healthy modern economy.

- In conjunction with the National Assembly and State Governments, the plan is to review and revise the Land Use Act.

- Streamline and rationalise the land conveyance process. In this way, the plan is to lower costs and delays and promote more efficient use of land. This more efficient allocation will bolster the housing industry and lower costs for investors and consumers.

- Working with State Governments, the intention is to provide credits and incentives to developers of housing projects that set aside a significant portion of their projects to affordable housing. With the support of State and Local Governments, TInubu’s team aims to establish and implement a new social housing policy whose objective shall be to provide pathways for the poorest Nigerians to climb onto the housing ladder.

- Establish a coherent federal program to provide eligible and meritorious civil servants with federal payment guarantees for fixed-rate, long-term mortgages for their homes.

- Tinubu’s plan also includes a chart that references a cumulative addition of 24 million housing units by 2028. Where 4 million housing units are added every year from 2023.

Estate Intel’s Synopsis Of Tinubu’s ‘Real Estate Manifesto’

Reform of the Land Use Act

Tinubu’s plan demonstrates an understanding of the existing structure with specific references to the major issues affecting the property market, the first being the Land Use Act of 1978. The explicit intention to work with the National Assembly and State Governments to rectify title issues and make crucial updates to the Land Use Act will make any real estate professional excited. If the right reforms are made on the Governor’s involvement in the process, inconsistencies within the act, alongside greater clarity on farmland, the impact on the property market will be notable.

Amplification and Improvement VS. New Ideas?

Some of the other ideas, however, build on already existing structures available at a national level or within Lagos specifically. While not exactly the same, the Lagos HOMS aims to accelerate growth by providing affordable mortgage finance and thereby promoting equal access to home ownership in Lagos State. Ideas around the establishment of a coherent federal program to provide eligible and meritorious civil servants with federal payment guarantees for fixed-rate, long-term mortgages for their homes, appear to be a ‘Federalisation’ of what has been a relatively successful program within Lagos State. One does worry, however, if amplification or improvement of existing schemes and plans is sufficient to truly push the needle and give Nigeria the change it needs.

Collapsing NMRC, FHA, and Others into One Master Agency

Finally, the plans to collapse ‘various federal agencies’ that are ‘too small and fragmented’ most likely speak to institutions such as the Nigerian Mortgage Refinance Company and the Federal Housing Authority. The tasks each of these organisations have been given are large and there might be a case for consolidation for efficiency. Without any indication of how this will be implemented, however, it is difficult to see how this will work in practice.

Obi’s ‘Real Estate Manifesto’

- Create financing incentives to unlock private capital provision of affordable social housing for Nigerian workers and people in proximity to their businesses and workplaces. The incentives will include tax concessions, streamlining of permitting processes, loan guarantees, and working with States for the dismantling of institutionalised brigandage.

- Diversify the funding for the national surface transportation system (roads, rail, bridges, and mass transit) and programs with the creation of the Highway Trust Fund Account. This account will be funded jointly by the Federal Government, States, and private sector on a ratio to be agreed with government participation limited to those areas where there is a manifest need for government intervention.

- Obi’s plans emphasises a shift from consumption to production by running a production-centred economy that is driven by an agrarian revolution and export-oriented industrialization.

- To ensure that the country’s economic production is equitably geared towards the net-zero emissions drive, the plan is to re-design incentives for present and prospective investors in the industrial sector, coupled with an apprenticeship system, to provide a ready-made source of technical expertise in the relevant areas.

- Aggressively prioritise the mechanisation of the huge endowment of arable land across the nation, particularly in the Northern region, to make agriculture the new oil of a prosperous Nigerian economy.

- Grow the national economy quantitatively and qualitatively by devising programmes for re-skilling the youth to achieve a greater synergy between their skill-sets and Nigeria’s factor endowments; create mandatory national certification for blue-collar artisans; strengthen some of the existing tertiary schools of science and engineering to train the next generation of experts in the Science, Technology, Engineering and Mathematics (STEM) field; and create a venture capital-like fund for young entrepreneurs.

- It has been established that Nigeria is among the top 10 countries most vulnerable to climate change, which poses the greatest economic, physical, financial, security, and developmental risks. But it also offers an enormous opportunity to unleash the green growth transition and boost prosperity. The plan is to establish a Green Army tasked with identifying all opportunities to tap into the $3tr in international climate finance to engineer economic growth and employment for millions of youth and transition Nigeria to the green epoch.

- Obi’s determination to reduce the cost of governance in Nigeria will start with the immediate implementation of the Oronsaye Report which recommended the consolidation of agencies of government. This will be their top priority within the first year of their administration.

- Obi’s team intends to demand the transparent liberalisation of the foreign exchange market and the dismantling of the opaque multiple exchange rate regime which effectively subsidises a few privileged persons, whilst depriving the government of badly needed revenues. When unaffordable subsidies are removed, some carefully calibrated transfers will be used to cushion any adverse impact on the economically weak.

- Pursue holistic poverty eradication with emphasis on agricultural revolution through effective utilisation of Nigeria’s vast arable lands, particularly in Northern Nigeria, and erase Nigeria’s categorization as the poverty capital of the world.

Estate Intel’s Synopsis Of Obi’s ‘Real Estate Manifesto’

Light on Direct Real Estate Initiatives

Interestingly, of all 3 manifestos analysed, Obi’s had the least direct real estate policy or plan outlined within it. However, a number of the general policies and goals within the document that target education, infrastructure development, and finance can have very strong and exciting implications for the Nigerian real estate sector.

Tapping into the Private Sector

Plans to use incentives such as tax concessions, loan guarantees, or the ‘streamlining of permitting processes’ to encourage the private sector to bring its capital for housing provision will be useful. Even more so when the private sector’s relative efficiency in housing delivery even with all the current challenges is considered. These are, however, plans and ideas that have been discussed in real estate and finance conferences over the past decade, but the effective implementation of these policies has not been seen. How will this be different?

Plans to create the Highway Trust Fund that will be jointly managed by the government and private sector are definitely commendable. Most residential development and eventual road development by the Government is first guided by large concentrations of private capital investment within the residential sector. A joint approach to the ‘national surface transportation system’ that involves both parties, will help developers focus on building property instead of trying to develop and build roads, sewage, and other infrastructure systems required to sell their homes. One potential downside here, however, is a collective collusion that may lead to faster-rising house prices and worsening housing affordability.

Obi has an eye for Sustainability

Finally, the net-zero emissions drive and recognition that Nigeria is among the top 10 countries most vulnerable to climate change are in line with current topical discussions around ESG in the global real estate space. The ‘Green Army’ that will be tasked with identifying funding opportunities in the $3tr in international climate finance should be able to find some success, however, much of Nigeria’s problem has not been securing funding or capital, but in deploying in full with minimal corruption and leakage. This is where the hard work lies.

What’s your verdict?

From what we have analysed, Atiku’s strategy is private-sector-led with a heavy focus on infrastructure development. Tinubu’s ideas for the real estate market are centred around home ownership and further mortgage reform, but also include specific references to the institutions he wishes to change alongside legislature that requires updating. Obi’s strategy takes a more macro approach that involves poverty alleviation, tapping into green global financing, and incentive-driven private sector support.

As we know from history, manifestos and campaign promises often stay as marketing material in the long run, so they must be considered in a measured manner. Nonetheless, we are curious, who is your favourite presidential candidate for Nigeria’s real estate market? Join the conversation on LinkedIn.

The manifestos for all three candidates can be found in Estate Intel’s report library using the links below.

Author Objectivity Factbox & Disclosures

- 2023 Election Party Allegiance: None.

- 2023 Election Voting Direction: Undecided.

*We reached out to each campaign team for comment during the 2nd week of December but have not received a response.

Source: estateintel