Here are housing policy lessons learnt during COVID-19

To aid American households experiencing distress during the COVID-19 pandemic, the U.S. government implemented a variety of programs and policies to aid renters and homeowners with mortgages. When the pandemic struck in early 2020, homeowners had substantially more equity in their homes than they did at the start of the Great Recession, leaving them in better financial shape than they were then and they enjoyed rising house prices. Renters were not so fortunate. Rents fell slightly below trend for a few months early in the pandemic and then accelerated.

Congress declared that homeowners who were experiencing hardship could postpone payments on their federally backed mortgage for up to 18 months with no penalty (known as forbearance). Many servicers of mortgages not backed by the federal government voluntarily did the same. In addition, mortgage rates fell, in part because of actions by the Federal Reserve, allowing many homeowners to reduce their monthly payments by refinancing their loans. For renters, Congress established the $46 billion Emergency Rental Assistance (ERA) program to help eligible households pay rent and utility bills. This program, coupled with federal, state, and local eviction moratoria, helped keep renters in their homes.

Evidence on housing policy

- The national forbearance mandate, foreclosure moratorium, enhanced Unemployment Insurance (UI), and Economic Impact Payments (EIPs) aided in reducing financial distress for both owners and renters at the outset of the pandemic and prevented longer-run problems in mortgage and housing markets.

- Over 80 percent of borrowers who missed a mortgage payment in the first three months of the pandemic enrolled in forbearance. Although minority mortgage borrowers were much more likely to experience distress and miss mortgage payments, conditional on missing payments, forbearance uptake was similar across racial and ethnic lines.

- Low interest rates led to a wave of refinancing, but fewer Black borrowers benefited from refinancing than white borrowers.

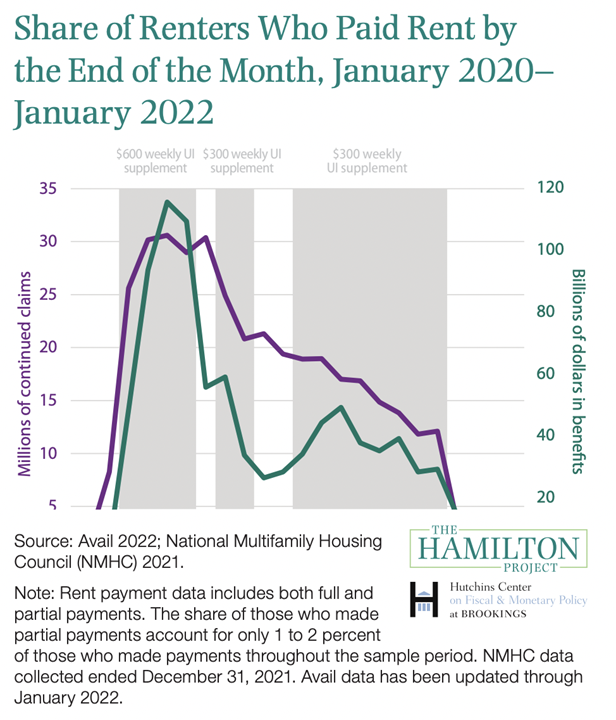

- The share of renters behind on rental payments has been above 2017 levels since 2020. Renter households who missed a rental payment were more likely to be lower-income households and were disproportionately minority households. Missed payments were most common among households who were struggling prior to the pandemic. The erratic rollout of the ERA, which was administered at the local level, prevented timely or easy access to these funds.

- Eviction moratoria resulted in a redirection of scarce household resources to immediate consumption needs and likely prevented homelessness. The decline in evictions during the pandemic is not solely the result of the eviction moratorium. The decline may also reflect the impact of ERA, greater access to legal aid, the impact of eviction diversion programs, and income replacement for households.

Lessons learned from housing policy during COVID-19

In noting Housing policy lessons learnt during COVID-19, Generous income replacement may be sufficient to support renters and homeowners if policymakers are concerned only with the incremental effect of the recession on those who were employed in the formal market before the recession. For renter households who were housing insecure before the pandemic, many without formal labor force attachment, this income replacement, the eviction moratorium and the ERA helped compensate for losses associated with the pandemic. However, these programs did not address the longstanding problems of this segment of the population which were worsened by pandemic.

Unlike the Home Affordable Modification Program implemented during the Great Recession, enrolling in forbearance required zero documentation on the part of borrowers. But it is unclear if it would be as effective in a future crisis as the state of the pre-pandemic housing and mortgage markets and the dynamic of the pandemic were set up almost perfectly for forbearance to be effective: the rapid labor market recovery meant that most borrowers only needed a few months of assistance, the majority of outstanding mortgage debt was insured by the U.S. government, and the housing market was exceptionally healthy.

The decline in mortgage interest rates had more modest effects: most borrowers experiencing pandemic-related financial distress were less likely to refinance. To ensure that the benefits of lower mortgage rates reach a broader set of borrowers in future downturns, one could develop and market alternative mortgage products that automatically lower payments when rates decline as well as support more widespread adoption of streamlined refinance programs that do not require employment or income verification.

Source: brookings